2013 Mn Property Tax Refund

Maximum refund allowed. Taxpayers may use the secure drop.

About Your Property Tax Statement Property Records Taxation Anoka County Mn

By mid-August if you are a renter or mobile home owner and you filed by June 15 or within 60 days after you file whichever is later.

2013 mn property tax refund. Taxes will be due for each cycle of equipment purchases. On a regional basis the ETR in Greater Minnesota grew from 20 to 21. Property tax over threshold 1 6 7 3132.

You must sign below. City of Columbus Income Tax Division 77 N. 2013 Tax Bill Improves Property Tax Refunds for Renters and Homeowners 2314 University Avenue West Suite 20 St.

Paul MN 55145-0020 9995 Disabled Veterans Homestead Exclusion see instructions Title. So from the standpoint of federal tax deduction the MN property tax refund is indeed a reduction in the 2019 local taxes paid rather than a refund of taxes paid in 2018. 614 645-7193 Customer Service Hours.

Minnesota Revenue Department studies have shown that business taxes passed along to consumers are the states most regressive taxes that is the most burdensome for lower income taxpayers. Remaining tax over threshold 7 9 10 2349. 35or direct deposit of your refund on line 17 of this Form M1PR enterF 201322 Your signature Date Daytime phone I declare that this return is correct and complete to the best of my knowledge and belief.

And the increase must be 100 or more. It was reduced to 15 percent for refunds based on rent paid in 2009 only under Gov. How to claim your refund Go to wwwrevenuestatemnus to file electronically or download Form M1PR.

To obtain the refund status of your 2020 tax return you must enter your social security number your date of birth the type of tax and whether it is an amended return. You may receive your refund earlier if you file electronically. Taxpayer copay amount 7 x 8 9 783.

If the MN department receives your properly completed return and all enclosures are correct and complete you can expect your refund. Enters Include your 2013 CRPR Mail to. Form M1PR for the 2018 Property Tax refund says that the refund is a function of taxable income for tax year 2018 and property taxes payable in 2019.

Due to the COVID-19 pandemic the Division is currently closed to the public. Correct amount 1 Federal adjusted gross income from line 37 of federal Form 1040. Minnesota Property Tax Refund St.

If you are a homeowner you may also be eligible for a special property tax refund. Download this image for free by clicking download button below. Minnesota Property Tax Refund Working together to fund Minnesotas future.

It also increased the maximum refund to 2000 for refunds based on rent paid in 2013. 2013-tax-bill-improves-property-tax-refundspdf - Read File Online - Report Abuse. If you do not wish to submit your personal information over the Internet you may call our automated refund hotline at 1-800-282-1784.

Call 6512963781 or 18006529094 to have the form sent to you. Minnesota Revenue - M1PR St. You have up to two years to file for your refund.

The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. Delinquent tax refers to a tax that is unpaid after the payment due date. Information is believed to be accurate.

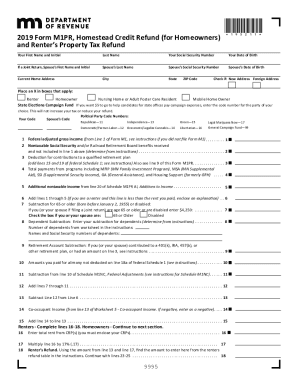

You must sign below. CBRE Economic Incentives Group. 2013 M1PRX Amended Homestead Credit Refund for Homeowners and Renter Property Tax Refund Print or Type You will need the 2013 Property Tax Refund instruction booklet including refund tables to complete this form.

If you own your home and meet the income limit you probably qualify. Refunds will be mailed in late September or early October if received by the August 15 deadline. For refunds based on rent paid from 1998 to 2008 the percentage of rent constituting property taxes was 19 percent.

Division of Income Tax home page. The maximum refund is 2530. This refund has no income limit and the maximum refund is 1000.

35or direct deposit of your refund on line 17 of this Form M1PR enterF 201322 Your signature Date Spouses signature if filing jointly Daytime phone I declare that this return is correct and complete to the best of my knowledge and belief. Your net property tax on your homestead must have increased more than 12 percent from 2019 to 2020. Otherwise you can expect your refund within 60 days of when filed.

Paul MN 55114 u2022 651-642-1904 Filename. Statewide net median burdens after property tax refunds as a share of homeowners income effective tax rate or ETR edged up from 23 in 2015 to 24 in 2016. Your net property tax on your homestead must have increased by more than 12 percent from 2012 to 2013.

Statutory copay percentage. That is purchases in 2013 would have personal property taxes from 2013-2017 and purchases in 2017 would have taxes due between 2017 and 2021 for example. Special property tax refund.

You can get your refund up to 30 days earlier if you file electronically and do the Filename. According to Minnesota Public Radio the average refund in recent years has been around 900 nothing to sneeze at. The due date for the M1PR is August 15 but returns will be accepted and processed through August 15 of the next year.

Special Property Tax Refund Requirements for Homeowners. U201cThe Renteru2019s Refundu201d Property Tax Refund Minnesota Property Tax Refund St. Monday through Friday 900 am.

848F4037-A0A4-5A32-1D12-3A8DA3FEAB26 - Read File Online - Report Abuse. If want a higher resolution you can find it on Google Images. Front Street 2nd Floor.

With metro-area homeowner taxes remaining unchanged at 26 since 2015. Minnesota Revenue - M1PR. Enters Include your 2013 CRPR Mail to.

2013 minnesota property tax refund instructions is important information with HD images sourced from all websites in the world. Renters who claimed the refund got an average of 654 back in their pocket. Special property tax refund you must have owned and lived in your home both on January 2 2012 and on January 2 2013.

2013 minnesota property tax refund instructions. PERSONAL PROPERTy TAx AbATEMENT POTENTIAL Statutorily Exempt Abatement Potential DiD you know. Net property tax refund.

You must have owned and lived in your home both on January 2 2019 and on January 2 2020. There is no income limit for the special property tax refund and the maximum refund is 1000.

Minnesota Tax And Spending Rankings And The Policy Questions They Provoke

Minnesota Results For The 50 State Property Tax Comparison Study For Taxes Payable In 2019

Mn State Tax Return Fill Online Printable Fillable Blank Pdffiller

Minnesota Results For The 50 State Property Tax Comparison Study For Taxes Payable In 2019

2017 Form Mn Dor M1pr Fill Online Printable Fillable Blank Pdffiller

Mn State Tax Return Fill Online Printable Fillable Blank Pdffiller

Minnesota Tax And Spending Rankings And The Policy Questions They Provoke

Basic Lease Agreement Template Elegant 30 Basic Editable Rental Agreement Form Templates Thogati Lease Agreement Rental Agreement Templates Contract Template

Prevailing Wage Prevailing Wage Compliance Davis Bacon Act Payroll Card Templates Printable Professional Templates

What Can You Maybe Expect After 8 10 Years Of Ownersh Homeowner 10 Years About Me Blog

Post a Comment for "2013 Mn Property Tax Refund"