West Allis Property Tax Rate

City of West Allis Assessor. And the City tax rate is set at 1202 for each 1000 of assessed value an increase from 1191.

1608 S 60th St West Allis Wi 53214 Realtor Com

Pre-payment of 2022 taxes may be made from August 1 2022 to December 20 2022.

West allis property tax rate. West Allis Wisconsin sales tax rate details. 7525 W Greenfield Avenue. Telephone property is assessed by the Wisconsin Department of Revenue and is taxed at the prior years net property tax rate of the taxing jurisdiction in which the telephone property is located.

View details map and photos of this single family property with 4 bedrooms and 3 total baths. The Greenfield Whitnall or West Allis-West Milwaukee School District. Pre-payment of 2021 taxes are allowed from August 1 2021 to December 21 2021.

And the City tax rate is set at 1191 for each 1000 of assessed value an increase from 1156. Tax amount varies by county. Tax Records include property tax assessments property appraisals and income tax records.

The City of West Allis Assessors Office is responsible for the maintenance of ownership information and the valuation of all taxable property within the City in accordance with The Wisconsin Property Assessment Manual PDF and Chapter 70 of the Wisconsin State Statutes. Get In-Depth Property Reports Info You May Not Find On Other Sites. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

The districts 2021-22 tax rate is 755 per 1000 of property value which is down from its 2020-21 tax rate of 875 per 1000 of property value. Our website can help you find information about the tax rates throughout the country including information about property records and how to determine the parcel number. Sold - 1032 S 87th St West Allis WI - 229900.

Telephone company property taxes are deposited in the state General Fund. Copies of tax receipts are only available by mail or by visiting the Treasurers Office at City Hall. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Tax levy is 44287249. The County sales tax rate is. West Allis WI 53214.

Property Tax Lawyers Milwaukee Office Serving West Allis WI. The minimum combined 2021 sales tax rate for West Allis Wisconsin is. Find the tax assessor for a different Wisconsin county.

The total rate for all taxing bodies in West Allis increased from 2379 per 1000 of assessed property value to 2459. The cost of the. Find property records for Milwaukee County.

The median property tax in Wisconsin is 300700 per year for a home worth the median value of 17080000. Treasurer city of west allis 7525 w greenfield ave west allis wi 53214 4143028221 parcel. The district raised its.

Contact the Treasurers Office. The city mailed out tax bills Dec. Our site offers details about assessor maps property records and the local property tax rate near West Allis WI on our property records directory.

Search Any Address 2. Best wishes for happy holiday season and happy New Year. Get driving directions to.

If requesting by mail please enclose a self-addressed stamped envelope and enclose 025 for each page. 740 North Plankinton Avenue Suite 600 Milwaukee WI 53203. Under State law the Citys job is to assign an assessment to each property in a Uniform and Equitable way so that the burden of property tax will be divided fairly between all property owners.

West Allis Wisconsin 53214. West Allis City Hall Room 102. This is the total of state county and city sales tax rates.

Copies of tax bills and tax payment receipts are available from the City of West Allis Treasurers Office. West Allis Christmas cards arent the only things arriving in the mail this month as city property owners also should have received their 2009 property tax bills by now. The median property tax in Milwaukee County Wisconsin is 370700.

Counties in Wisconsin collect an average of 176 of a propertys assesed fair market value as property tax per year. Greenfield While property owners will see lower tax rates on their tax bills levies are up at the city level and at the three school districts within Greenfield. Sincerely Mayor Dan Devine West Allis Common Council City of West Allis wwwwestalliswigov 414-302-8221 West Allis-West Milwaukee School District wwwwawmk12wius 414-604-3000.

It is our primary responsibility to provide uniform property values so. Wisconsin has one of the highest average property tax rates in the country with only eight states levying higher property. Best wishes for happy holiday season and happy New Year.

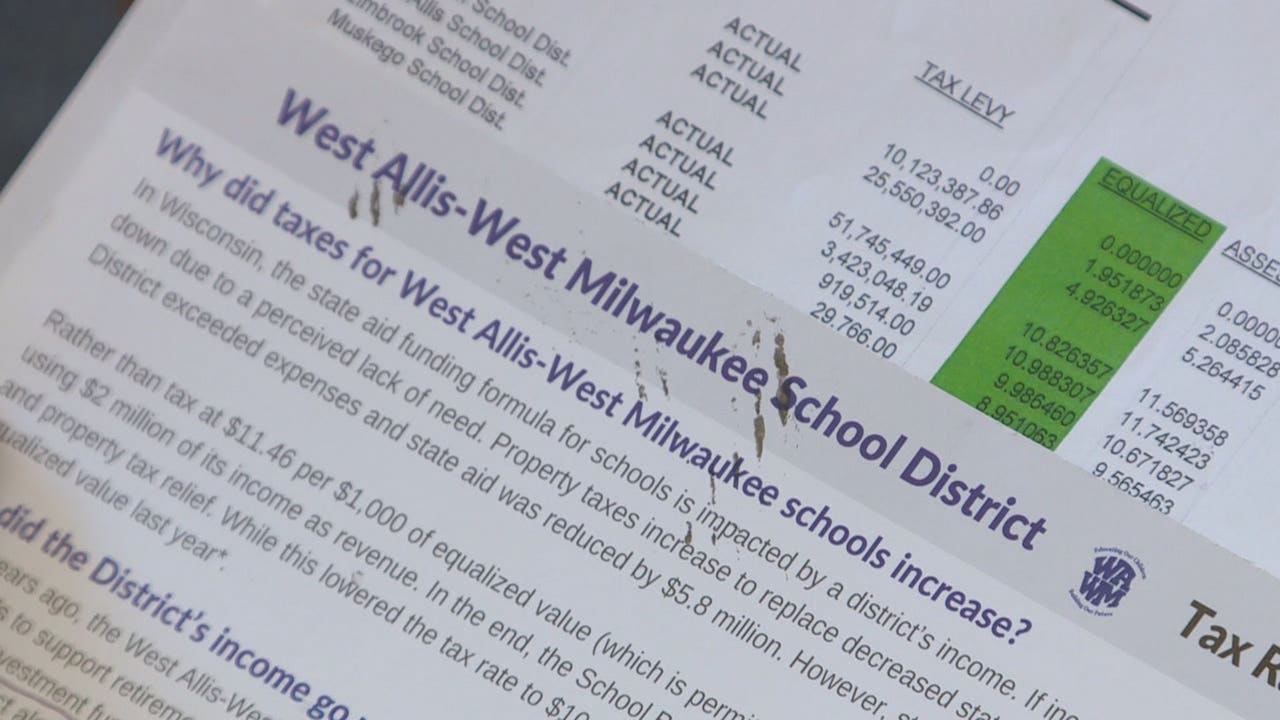

NEW BERLIN -- Homeowners in part of the West Allis-West Milwaukee School District got a lump of coal this Christmas in the form of a big tax increase. 414 302 8230 Phone 414 302 8238 Fax The City of West Allis Tax Assessors Office is located in West Allis Wisconsin. 7525 W Greenfield Avenue West Allis WI 53214.

The 80-cent increase is a 33 percent jump over last year. The City of West Allis Treasurers Office. Sincerely Mayor Dan Devine West Allis Common Council City of West Allis wwwwestalliswigov 414-302-8221 West Allis-West Milwaukee School District wwwwawmk12wius.

Certain Tax Records are considered public record which means they are available to the. Collects property taxes business personal property taxes and special assessments. Although you pay your annual tax bill to the West Allis Treasurers office the City does not keep most of the money you pay on tax day.

Krolikowski 2851 s 91st st west allis wi 53227 treasurer city of west allis 7525 w greenfield ave west allis wi 53214 make check payable to. All of the City of West Allis information on this page has been verified and checked for accuracy. West Allis Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in West Allis Wisconsin.

On the bills residents will find six taxing jurisdictions - the city of Greenfield. The Wisconsin sales tax rate is currently. Manages the Citys cash and investments.

West Allis WI 53214. See Property Records Deeds Owner Info Much More. Wilson Elser Moskowitz Edelman Dicker LLP.

The cost to taxpayers. Real estate property tax bill for 2020 city of west allis milwaukee county waab llc glenn b.

2528 S 72nd St West Allis Wi 53219 Realtor Com

2081 S 87th St West Allis Wi 53227 Home For Sale Mls 1770275 Shorewest Realtors

1617 S 56th St 1619 West Allis Wi 53214 5256 Home For Sale Mls 1767069 Shorewest Realtors

1031 S 73rd St 1033 West Allis Wi 53214 Realtor Com

West Allis Wisconsin Wi 53227 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

904 S 74th St West Allis Wi 53214 Realtor Com

1600 S 93rd St West Allis Wi 53214 4269 Home For Sale Mls 1766852 Shorewest Realtors

West Allis Wisconsin Wi 53227 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

West Allis Property Management West Allis Property Managers West Allis Property Management Companies Pmi Greater Milwaukee

2133 S 69th St West Allis Wi 53219 1322 Home For Sale Mls 1749989 Shorewest Realtors

3161 S 106th St West Allis Wi 53227 Home For Sale Mls 1759424 Shorewest Realtors

2243 S 71st St West Allis Wi 53219 Realtor Com

Homeowners In West Allis West Milwaukee School District Complain About Uneven Property Tax Hike

8926 W Mitchell St West Allis Wi 53214 Realtor Com

2223 S 67th Pl West Allis Wi 53219 Realtor Com

West Allis Wisconsin Wi 53227 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

West Allis Wisconsin Wi 53227 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Post a Comment for "West Allis Property Tax Rate"