Michigan Property Tax Credit 2016

Homesteads with a taxable value greater than 135000 are not eligible for this credit. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Florida Property Tax H R Block

Elder Law of Michigan Inc.

Michigan property tax credit 2016. If you are looking for Individual Income tax forms to file a Michigan Homestead Property Tax Credit MI-1040CR. If you received a farmland preservation tax credit in 2016 homestead you must include it in total household resources. The home you shared was rented multiply the monthly The Michigan Individual Income Tax MI-1040 or if applicable the Michigan Homestead Property Tax Credit Claim for Veterans and Blind People MI-1040CR-2 booklets.

See the income tax. Homestead property tax credit Eligible homeowners or renters who pay more than 3 5 percent of their household income in property taxes or in rent for renters can receive a credit or rebate on their state income tax. Access IRS Tax Forms.

Energy and property tax credit 2015. Free income tax preparation - Accounting Aid Society Duffield Branch Library. 1 4 Attachment 05 1.

2016-07-24 The Michigan Homestead Property Tax Credit For All Other Filers. If you enter the word annual in the filter box only the forms that include that word in the title will. The information contained in this booklet may ease the burden of filling out state tax forms and may even save some taxpayers money.

Michigan Department of Treasury Rev. Type or print in blue or black ink. Homestead Property Tax Credit Claim for Veterans and Blind People.

Instructions included on form. Homestead Property Tax Credit Claim 2020 Michigan Homestead Property Tax Credit Claim MI-1040CR Reset Form Michigan Department of Treasury Rev. 2016 Michigan Homestead Property Tax Credit Claim MI-1040CR.

Print numbers like this. The filing deadline to receive a 2015 property tax credit is April 15 2020. To avoid penalty and interest if you owe tax postmark no later than April 18 2016.

Michigan Homestead Property Tax Credit. You may Step 2. Exemption may be appealed to the Michigan Tax Tribunal within 35 days from date of notice.

Subtract the business portion of your homestead property tax 2150 total taxes - 858 taxes claimed as a business credit if you included it in taxable farm income. Instructions included on form. The Michigan Homestead Tax Credit gives some Michigan residents a refund on the amount of property taxes they owe or the amount of property taxes their landlord owes.

Worksheet for Determining Support. ELM a 501c3 is a nonprofit charitable organization that promotes and protects the rights health and economic well-being of older adults and people with disabilities. For example if you search using tax year 2016 and Motor Carrier as the tax area 40 form results would be displayed.

2021 Iowa Property Tax Credit Claim Instructions. If you are looking for Individual Income tax forms to file a Michigan Homestead Property Tax Credit MI-1040CR select Homestead Property Tax IIT from the subject drop-down menu. Homeownersfor the Michigan Homestead Property Tax Credit.

Counties in Michigan collect an average of 162 of a propertys assesed fair market value as property tax per year. Michigans homestead property tax credit is how the State of Michigan can help you pay some of your property taxes if you are a qualified Michigan homeowner or renter and meet the requirements. This booklet contains information for your 2017 Michigan property taxes and 2016 individual income taxes homestead property tax credits farmland and open space tax relief and the home heating credit program.

0123456789 - NOT like this. Filers First Name MI. You should complete the Michigan Homestead Property Tax Credit Claim MI-1040CR to see if you qualify for the credit.

Are claiming a credit. Michigan is ranked number eighteen out of the fifty states in order of the average amount of property taxes collected. 05-18 Page 1 of 3 Amended Return 2018 MICHIGAN Homestead Property Tax Credit Claim MI-1040CR Issued under authority of Public Act 281 of 1967 as amended.

HOMESTEAD PROPERTY TAX CREDIT Eligible homeowners or renters who pay more than 3 5 percent of their household income in property taxes or in rent for renters can receive a credit or rebate on their state income tax. 05-16 Page 1 of 3 Issued under authority of Public Act 281 of 1967 as amended. Address of homestead sold moved from during 2016 Number Street City State ZIP Code.

2016 MICHIGAN Homestead Property Tax Credit Claim MI-1040CR Type or print in blue or black inkPrint numbers like this. Deduction 1292 taxes attributable to homestead. Address where you lived on December 31 2016 if different than reported on line 1 Number Street City State ZIP Code.

Statement to Determine State of Domicile. Michigan homestead property tax credit instructions 2015. Amending Your Credit Claim.

05-20 Page 1 of 3 2020 MICHIGAN Homestead Property Tax Credit Claim MI-1040CR Amended Return Issued under authority of Public Act 281 of 1967 as amended. Total annual income amount for each spouse for the tax year. For the 2020 income tax returns the individual income tax rate for Michigan taxpayers is.

Homeowners Property Tax Credit Application Form HTC 2021 The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income. Michigan income tax return your credit claim should be attached to your MI-1040 return and filed by April 18 2016 to be considered timely. Complete Edit or Print Tax Forms Instantly.

0123456789 - NOT like this. Oakland County Treasurers Office. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000.

1 4 Attachment 05 1. A document submitted as evidence to the Michigan Tax Tribunal shows correspondence from the Cook County Illinois assessors office regarding Kent Walczaks 2016 Illinois exemption and his. Michigan Department of Treasury Rev.

Principal Residence ExemptionProperty Tax. Instructions included on form. This booklet contains information for your 2021 Michigan property taxes and 2020 individual income taxes homestead property tax credits farmland and open space tax relief and the home heating credit program.

Property tax bills or lease agreements for the tax year. 2015 colorado tax form 104. When e-iling your 2016 Farmland Preservation Tax Credit Claim MI-1040CR-5 with your Michigan Individual Income Tax Return MI-1040 you must also ile a completed Homestead Property Tax Credit Claim MI-1040CR or MI-1040CR-2 or Home Heating Credit Claim MI-1040CR-7 even if you are not qualiied to receive these credits.

The Federal Geothermal Tax Credit Your Questions Answered

Michigan Property Tax H R Block

What Is A Homestead Exemption And How Does It Work Lendingtree

Deducting Property Taxes H R Block

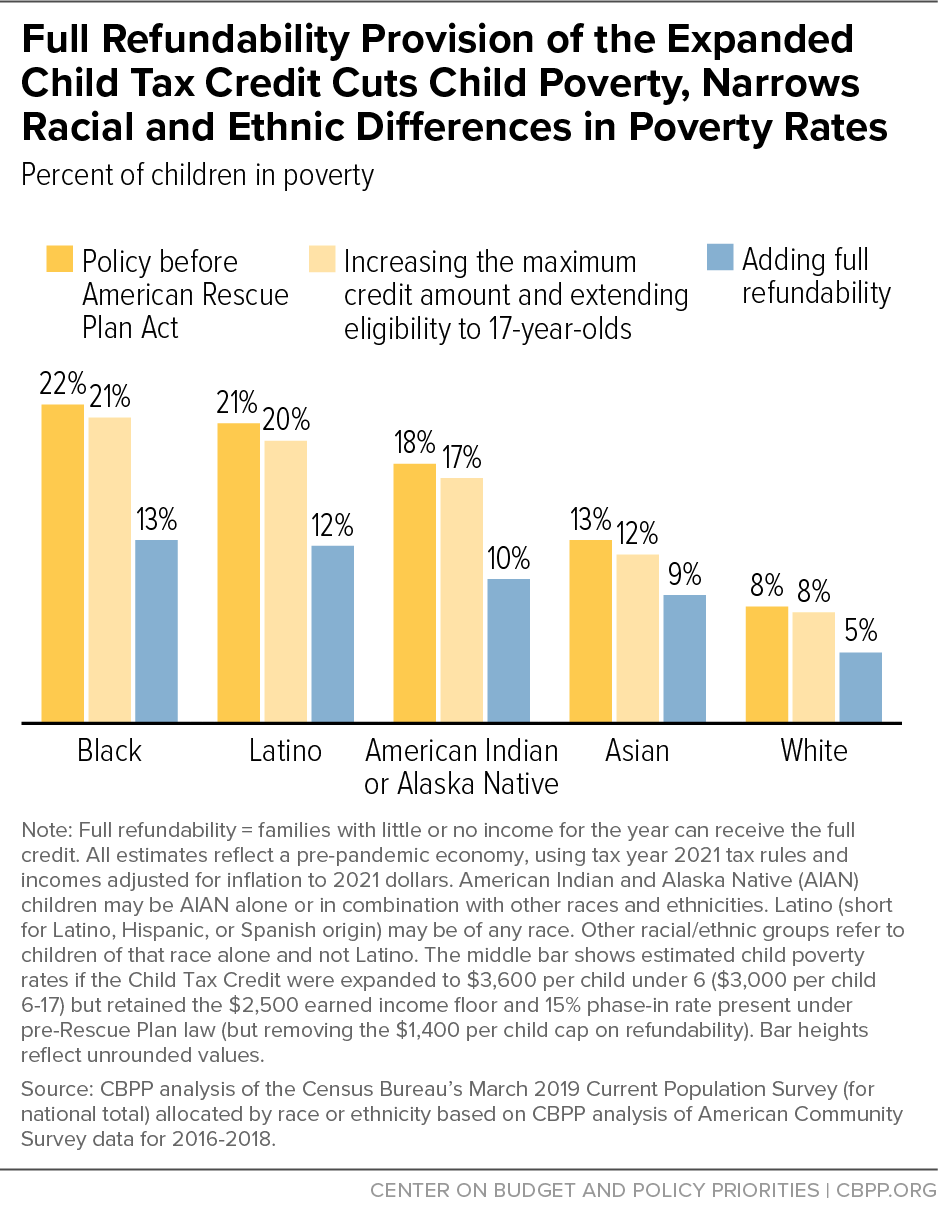

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Property Taxes By State Embrace Higher Property Taxes

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Property Taxes By State Embrace Higher Property Taxes

Amt Tax Credit Form 8801 H R Block

Where S My Refund Michigan H R Block

Using The Low Income Housing Tax Credit To Fill The Rental Housing Gap Health Affairs

Increasing Share Of U S Households Paying No Income Tax

State Of Michigan Taxes H R Block

Pin On Global Issues Economics

Effects Of Income Tax Changes On Economic Growth

State Historic Tax Credits Preservation Leadership Forum A Program Of The National Trust For Historic Preservation

Post a Comment for "Michigan Property Tax Credit 2016"