Whitley County, Ky Property Taxes

Dedicated to Excellence Protecting Our Community. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Zebulon Gt Magnet Middle School Zebulon Middle School School

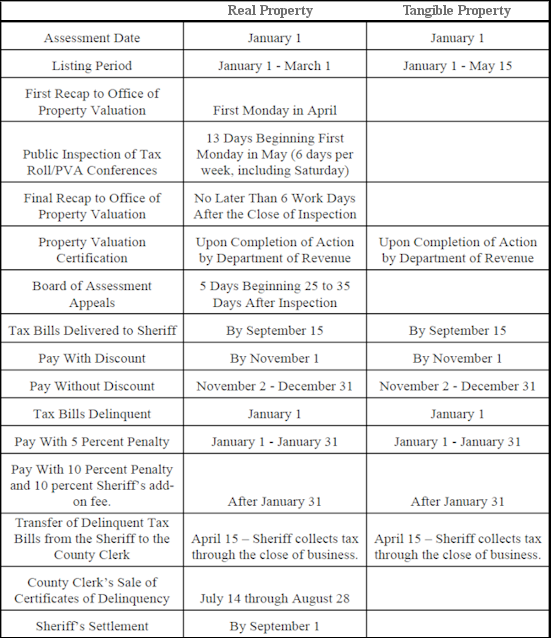

3 a 5 percent late fee will be added to all unpaid 2017 property tax bills.

Whitley county, ky property taxes. To pay their bills with a 2 percent discount. The County Treasurer is appointed by the Fiscal Court and is responsible for fulfilling requirements set out by KRS 68210 68020 68300 68360 and the Uniform Systems of Accounts for Kentucky Counties. Whitley County has one of the lowest median property tax rates in the country with only two thousand five hundred seventy two of the 3143 counties collecting a.

You may look up your taxes by name property address or parcel number. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. There are three major roles involved in administering property taxes - Tax Assessor Property Appraiser and Tax CollectorNote that in some counties one or more of these roles may be held by the same individual or office.

Whitley County Property Records are real estate documents that contain information related to real property in Whitley County Kentucky. 606 549-6002 606 549-6003. Get In-Depth Property Reports Info You May Not Find On Other Sites.

Whitley County Assessors Office Services. 200 Main St 2 Williamsburg KY 40769. Policies and Procedures July 8 2021.

See Property Records Deeds Owner Info Much More. On phones this is usually found by. Property owners have until Jan.

Click the link below to view your tax bill online. This website is dedicated to promoting a realistic goal in helping the public understand the workings of the PVA. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system.

200 Main Street 2nd Floor - Courthouse Williamsburg KY 40769 Phone. Search Any Address 2. Welcome to the Whitley County Kentucky PVA Office Welcome to the website for the Whitley County PVA.

Office and the steps that are followed to treat everyone fairly and in an equitable manner. Whitley County collects on average 065 of a propertys assessed fair market value as property tax. The median property tax also known as real estate tax in Whitley County is 41800 per year based on a median home value of 6440000 and a median effective property tax rate of 065 of property value.

Website Update July 2 2021. The Whitley County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Whitley County and may establish the amount of tax due on that property based on the fair market value appraisal. Mail-in ballots can either be mailed back to the Clerks Office or dropped in one of our drop boxes located at the Whitley County Courthouse and the Corbin City Hall.

Whitley County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by property tax collections. You will need to DISABLE POP-UPS on your browser to view your tax bill. 2019 Whitley County Tax Bill Sale will be held on Monday August 17th at 900am.

The AcreValue Whitley County KY plat map sourced from the Whitley County KY tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. We shall maintain the website to address questions about. Open Records Request July 9 2021.

Whitley County Fiscal Court. Whitley County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Whitley County Kentucky. There will be prior year tax bills available at the 2019 sale.

If you have specific knowledge about a property and you believe some or all data contained on this web page to be incorrect. To pay their bills at the face value. Various sections will be devoted to major topics such as.

Pay Property Tax Online in Whitley County Kentucky using this service. 2019 Delinquent Property Tax Bills. To verify what your property tax bill is or to verify that a tax payment has been made visit the Whitley County GIS page to look up your tax information.

These records can include Whitley County property tax assessments and assessment challenges appraisals and income taxes. Whitley County Assessors Office Services. The assessment of property setting property tax rates and the billing and.

You may also contact our office and we can verify your payment. 1 the penalty jumps to 21 percent. 2 at 430 pm.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner. The median property tax in Whitley County Kentucky is 418 per year for a home worth the median value of 64400. Box 118 Williamsburg KY 40769 Phone.

Whitley County property owners have until Nov. 606 549-6008 549-6009 Fax. Please note that this site is updated nightly.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Whitley County KY at tax lien auctions or online distressed asset sales. Whitley County Fiscal Court. 1 at 430 pm.

AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Payments will not be accepted on Monday August 17th.

All third party purchasers who meet the following conditions must register with the Department of Revenue. Real and personal property taxes for the 2020 pay 2021 year are due on may 10 2021 for the 1st installment and on november 10 2021 for the 2nd installment The Whitley County Treasurer offers several convenient options to make Real and Personal Property Tax Payments. WHITLEY COUNTY SHERIFF.

Whitley County Kentucky Tax Assessors Office

Whitley County Ky Unrestricted Land For Sale Landsearch

Free Delivery And Set Up Within 200 Miles Of Corbin Ky Lofted Cabin Shed Sizes Shed Storage

Delinquent Property Tax Department Of Revenue

2391 Kentucky Highway 26 Corbin Ky 40701 Realtor Com

Physick The Professional Practice Of Medicine In Williamsburg Virginia 1740 1775 Williamsburg Virginia Medicine Virginia

Cheap Homes For Sale In Laurel County Ky 29 Listings

Kentucky Farms For Sale 928 Ranches Acreages For Sale

Letcher County Ky Real Estate 15 Homes For Sale In Letcher County

2694 Buck Creek Rd Williamsburg Ky 40769 Realtor Com

1939 Bethel Rd Pine Knot Ky 42635 Trulia

Whitley County Real Estate Whitley County Ky Homes For Sale Zillow

703 Jordan Hollow Rd Williamsburg Ky 40769 Mls 20112532 Re Max

Post a Comment for "Whitley County, Ky Property Taxes"