San Benito County Property Tax Rate

The mission of this office is to effectively and efficiently perform the duties and responsibilities of each function with excellence in customer service and fiscal responsibility. 23 approved a 15-year commercial and industrial tax-sharing agreement with Hollister.

San Benito County Employee Pay

The 202122 Secured Property Tax bills are now available to view and pay online.

San benito county property tax rate. The first installment is due November 1 2021 and will be considered late if not paid by December 10 2021. The Citys Property tax notices can be found in the following documents. SAN BENITO Climbing revenues stemming from property reappraisals could lead city commissioners to consider trimming the tax rate while officials might even hold off a water rate hike during the upcoming fiscal year.

According to the agreement any commercial or industrial project or property that is annexed into Hollister will provide 70 of the tax revenue to the city and 30 to the county. Agencies interested in having access to the database please contact the Assessors office for information and rates. The median property tax also known as real estate tax in San Benito County is 371600 per year based on a median home value of 54230000 and a median effective property tax rate of 069 of property value.

The San Benito County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within San Benito County and may establish the amount of tax due on that property based on. The median property tax on a 54230000 house is 401302 in California. Offered by County of San Benito California.

The median property tax on a 54230000 house is 374187 in San Benito County. San Benito County Property Tax Collections Total San Benito County California. In San Benito County Treasurer Tax Collector and Public Administrator have been consolidated into a single elective position with a four-year term.

Property Taxes Mortgage 39495400. San Benito County California sales tax rate details. Property Tax Rates County Median Home Value Average Effective Property Tax Rate Riverside 304500 097 Sacramento 299900 084 San Benito 459700 082 San Bernardino 280200 083 Likewise what the sales tax San Bernardino County 775 Beside.

All tax bills related to this property will be displayed. 8 rows SEE Detailed property tax report for 106 Pearce Ln San Benito County CA. Select the appropriate ASMT number you wish to pay.

The minimum combined 2021 sales tax rate for San Benito County California is. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the San Benito County Tax Appraisers office. Property Taxes No Mortgage 9563100.

800am - 500pm Phone. 2015 Notice of Tax Year Proposed Property Tax Rate PDF 2015 Property Tax Rates in the City of San Benito PDF 2015 Notice of Public Hearing on Tax Increase PDF 2015 Notice of Tax Revenue Increase PDF 2016 Tax Rate Ordinance 2536 PDF 2017 Tax Rate Ordinance 2543. Get In-Depth Property Reports Info You May Not Find On Other Sites.

Proposition 13 limits the tax rate to 1 of a propertys current assessed value plus any voter-approved bonds and assessments. If you do not receive your bill by November 1 2021 please call us at 831 636-4034. At City Hall officials might shift money to pay for more street repairs as City Manager Manuel De La Rosa closes in on.

However property is reassessed whenever it changes owners or undergoes new construction. San Benito County Assessors Office Services. The California state sales tax rate is currently.

The San Benito County sales tax rate is. San Benito County Property Records are real estate documents that contain information related to real property in San Benito County California. Enter the search criteria by entering the ASMT number you wish to pay.

Search Any Address 2. In a 3-2 vote the San Benito County Board of Supervisors on Nov. See Property Records Deeds Owner Info Much More.

The 2018 United States Supreme Court decision in South Dakota v. County of San Benito Office of the Auditor 481 Fourth Street Second Floor Hollister CA 95023 Office hours. This is the total of state and county sales tax rates.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The proposition also states that property values cant increase more than 2 annually based on the California Consumer Price Index.

Further Changes Made To Measure N Ballot Question Benitolink

Supplemental Taxes San Benito County Ca

Integrated Waste Management San Benito County Ca

Welcome To The San Benito County Tax Collector S Website San Benito County Ca

Welcome To The San Benito County Tax Collector S Website San Benito County Ca

Construction Demolition Recycling Plan San Benito County Ca

Welcome To The San Benito County Tax Collector S Website San Benito County Ca

Fee Schedule San Benito County Ca

Construction Demolition Recycling Plan San Benito County Ca

San Benito County Employee Pay

San Benito County Employee Pay

California Public Records Public Records California Public

Recycling Guides San Benito County Ca

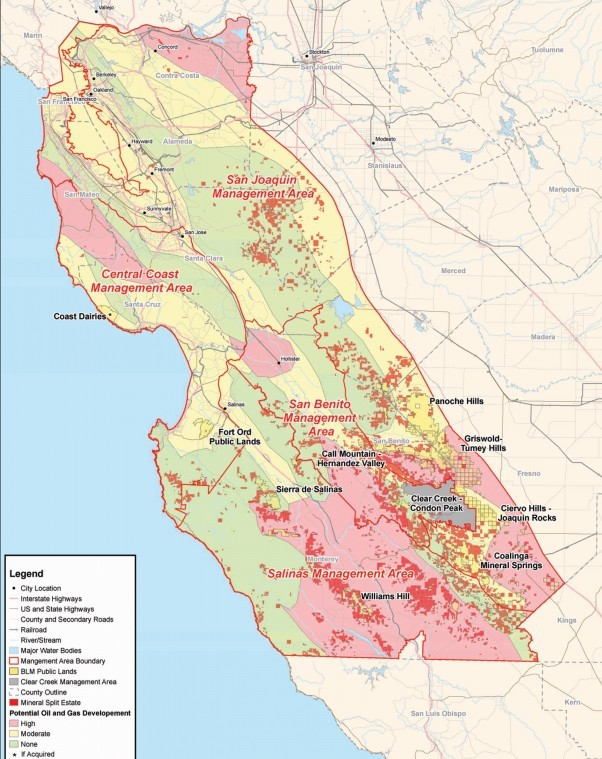

The Oil Play Technology Market Stir Renewed Interest In San Benito County Sanbenito Com Hollister San Juan Bautista Ca

San Benito County Faces Lawsuits On Hwy Nodes Retiree Health Plans Benitolink

Non Exclusive Franchise Agreement For Waste Collection San Benito County Ca

Post a Comment for "San Benito County Property Tax Rate"