Loudoun County Property Assessments

Searching Up-To-Date Real Estate Records By County Just Got Easier. Loudoun County Government PO.

Loudoun S Data Center Tax Revenue Is Accelerating At An Insane Pace Washington Business Journal

Box 7000 Leesburg VA 20177 Phone.

Loudoun county property assessments. The due dates are June 5 and December 5. If real estate is used for agricultural forestal or open space purposes the owner may apply to have the land assessed for this use which in most cases results in. Personal Property Taxes and Assessments.

Taxes in Loudoun County Loudoun County VA Official. SE Leesburg VA 20175. Box 7000 Leesburg VA 20177 Phone.

Condominium garage units or assigned parking spaces associated with condominiums may have separate parcel identification numbers - and will be assessed separately. Supervisors also have the option to lower personal property taxes on classes of property individually. Area the county renewal objectives of sections 30326 to 30356 inclusive of the Revised Code in accordance with the county renewal plan.

Box 7000 Leesburg VA 20177 Phone. Loudoun County Assessment Rolls httpsreparcelasmtloudoungovptsearchcommonsearchaspx Search Loudoun County property assessments by tax roll parcel number property owner address and taxable value. Any errors or omissions should be reported for investigation.

It is the Assessors responsibility to discover list classify and value all property within the county for tax purposes. Disposition of any property acquired in the county renewal area including sale initial leasing or retention by the county itself at its fair value for. Loudoun Loudoungov Show details.

Loudoun County Government PO. Currently Loudoun taxes most personal property at 420 per 100 of assessed value with lower rates for some categories such as vehicles used by the elderly or disabled and manufactured homes. Just Enter your Zip Code for Home Prices Near You.

W elcome to the web site of the Loudon County Property Assessor. Extends the date for the payment of the real property taxes and assessments in the County for the second-half collection of tax year 2019 from July 20 2020 to August 13 2020 pursuant to Ohio Revised Code section 32317. 0980 per 100 in assessed value.

If real estate is used for agricultural forestal or open space purposes the owner may apply to have the land assessed for this use which in most cases results in a lower assessed value. Loudoun County Government PO. Box 7000 Leesburg VA 20177 Phone.

Loudoun County collects personal property taxes on automobiles motorcycles trucks boats campers mobile homes trailers and aircraft. Loudoun County Database of Real Property Assessment and Land Parcel Information. Real estate in Virginia is assessed at 100 of its fair market value.

Search Any Address 2. SE Leesburg VA 20175. The Loudoun County Treasurers office makes every effort to produce and publish the most current and accurate tax information possible.

Expert Results for Free. Loudoun County Database of Real Property Assessment and Land Parcel Information. Condominium garage units or assigned parking spaces associated with condominiums may have separate parcel identification numbers - and will be assessed separately.

Personal Property Tax Rate. 2 hours ago Loudoun County real estate taxes are collected twice a year. SE Leesburg VA 20175.

The 2021 Real Property Tax Rate for Regular District 1. Real Estate Loudoun County VA - Official Website. Ad Easily Find House Values Online.

Parcels are linked to the Loudoun County GIS with map overlays displaying boundary and environmental information such as topography soils flood plain and major roads. No warranties expressed or implied are provided for. Personal property taxes are due May 5 and October 5.

Real estate taxes are calculated on 100 percent of assessed value. The Loudon County Assessor of Property is a Tennessee constitutionally elected official who serves at the pleasure of the Loudon County citizens for a four-year term of office. Loudoun County real estate taxes are collected twice a year.

Jan 01 2019 Loudoun County collects personal property taxes on automobiles motorcycles trucks boats campers mobile homes trailers and aircraft. Just Enter Your Zip for Instant Results. Loudoun County Government PO.

The Loudoun County Commissioner of the Revenue provides annual assessments of real estate within the Town of Leesburg in January of each year based on fair market value. See Property Records Deeds Owner Info Much More. Real estate taxes are based on real property assessments and the real property tax rate which is set annually by the Board of Supervisors.

The purpose of this site is to provide you the county taxpayer with the information and tools you need to understand your property assessments the countys property tax system in general and to access the many resources available to you through the. Real Estate Taxes and Assessments. Personal property tax rate.

Real Estate Assessments FAQs. Click for current property assessment data. Parcels are linked to the Loudoun County GIS with map overlays displaying boundary and environmental information such as topography soils flood plain and major roads.

Personal property taxes are due May 5 and October 5. SE Leesburg VA 20175. Connect To The People Places In Your Neighborhood Beyond.

In consideration of the foregoing extension the Tax Commissioner directs that the extension be. Ad Get Assessment Information From 2021 About Any County Property. The due dates are June 5 and December 5.

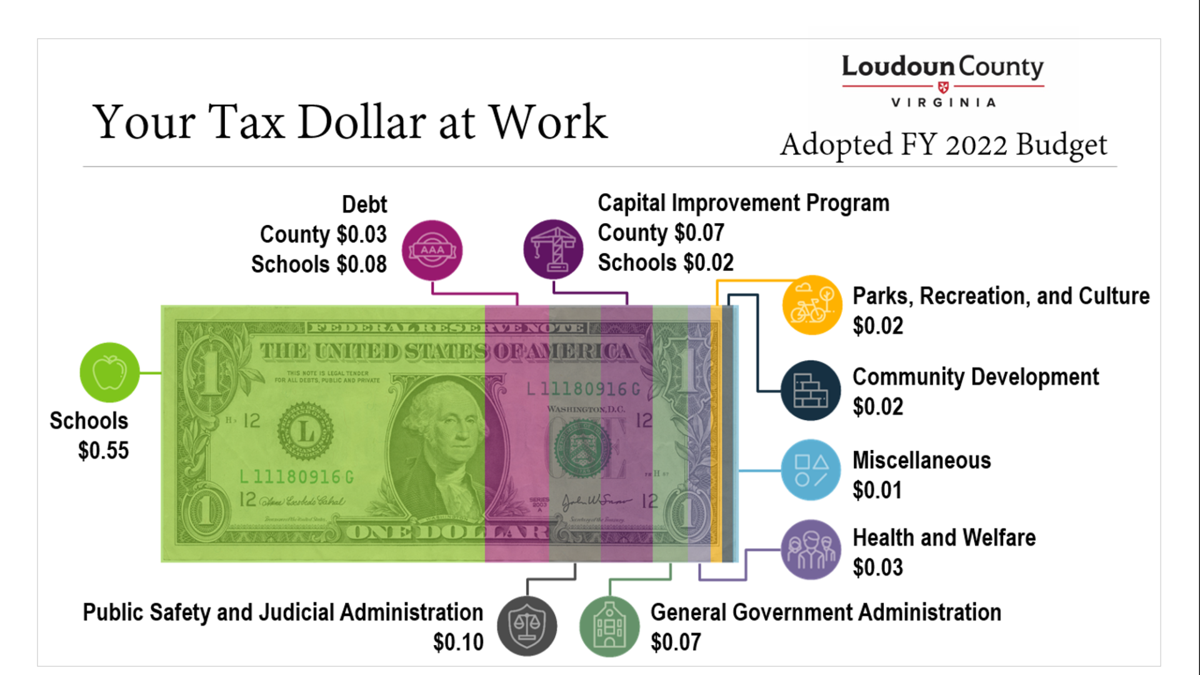

Loudoun County Administrator Proposes 3 3b Budget For Fiscal 2022 News Loudountimes Com

News Announcements Loudoun County Va Civicengage

With Level Tax Rate Loudoun County Tax Bills May Be On The Rise News Loudountimes Com

Loudoun Supervisors Ready To Sign Off On 3 2b Budget News Loudountimes Com

News Announcements Loudoun County Va Civicengage

News Announcements Loudoun County Va Civicengage

News Announcements Loudoun County Va Civicengage

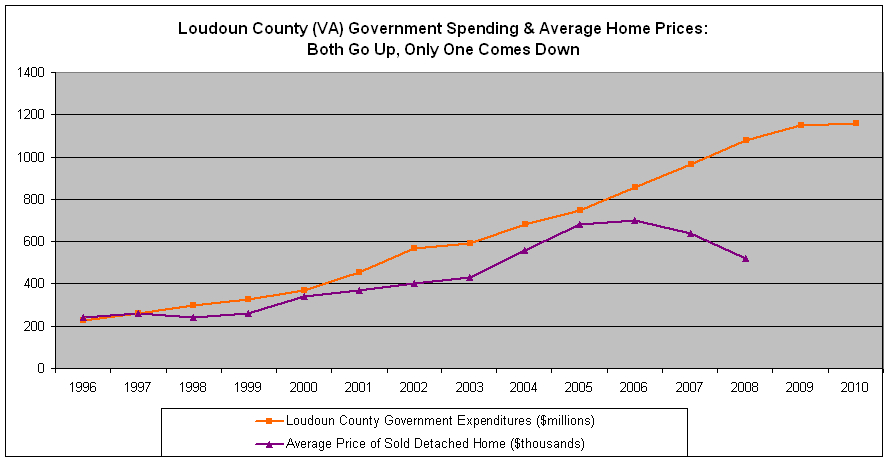

Property Tax Rates Going Up In Once Booming Virginia Exurb Tax Foundation

Here S Your Chance To Weigh In On The Loudoun County Fiscal Year 2020 Budget

Loudoun County Mails Out 2019 Property Assessments Wtop News

Property Tax Rates Going Up In Once Booming Virginia Exurb Tax Foundation

News Announcements Loudoun County Va Civicengage

Taxing Loudoun How Much Of Your Paycheck Does The County Get Loudoun Now

Loudoun Second Half Personal Property Tax Deadline Oct 5 Loudoun Now

Real Property Tax Deadline Dec 6 Loudoun Now

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Vehicle Values Could Impact Loudoun County Property Taxes Due May 5 Commissioner Says News Loudountimes Com

Post a Comment for "Loudoun County Property Assessments"