Zakat On Rental Property

With regard to real estate that a person acquires for the purpose of making use of it ie by renting it out and benefitting from the income generated thereby there is no zakaah on its value. Ie from what I have gathered on the internet.

Amana Funds Investing And Zakah Saturna Capital

Some scholars have also opined that the calculation of the zakaah on the rented house should be treated like the calculation of artificially irrigated agricultural land and the owner must pay a 5 zakaah on the gross annual rent.

Zakat on rental property. Zakat on property and other fixed assets. Features 3 Bedrooms 2 Full baths Large Living room Beautiful Kitchen 1st floor laundry View Property. Only the rental income is subject to Zakat.

Rental property Because Rental properties are not in the use of the owner one must pay Zakat on the property of this nature. Zakat is due on the rent cash that of you receive from renting this property if it fulfills the conditions of zakatable items ie. Rental income become part of my saving and I pay zakat on it.

In other words you will be paying Zakat either on the land or property if the deal is complete or on the instalments given if the land or property has not as yet come into your ownership. Zakat on Rental Property. Therefore it must be subject to Zakah.

If a person buys a house apartment or any other building and rents it out then scholars are of the view that Zakat is applicable on rental earning. What if the monthly or quarterly rental income is totally spent before a full lunar year ends. Salaam sorry to revive an old thread but it appears that more scholars agree including Shk Al Qardawi that Zakat is due on the rent of an investment and not on the property itself.

We have established that if the land is purchased for investment purposes then zakat has to be paid every year until it gets sold. The year for the rent starts from when the rental contract begins. Discover 580 commercial properties for lease including offices retail and industrial spaces.

It exceeds the exemption limit nisab and has been in your possession for more than a Islamic lunar year. My son is studying in a different city. Theres a total of 580 commercial listings available for rent in Columbus OH.

If one has a rental property the zakat due at the end of the lunar year is on the rental income not the property value or original capital. 1199 per month. Also there is an authentic hadith that says that Zakah is a duty upon the rich and the owner of rental property is rich.

When is Zakat Applicable to the Property. Zakat on Property for Long-Term Investment. Across 783 unique spaces there is a grand total of 14146894 square feet.

You buy a property with. Is zakah due on rental property. So we can boil buy-to-let property down to a fairly simple rule.

Zakah on property My question is about Zakah Suppose I have some fixed assets that are giving some profit for me Say I have a property worth of two million rupees and I get profit from that assets Now my question is whether I have to pay the Zakah of those assets every year or only once in the lifetime Also if the assets are dead ie I do not get any benefit from. I have rental income and paying zakat only on net saving of rental income. Join us on our official pages for Huda Tv on Facebook.

In other words all the capital assets which generate income are subjected to zakat. The general principle that came in the verse of Surat At-Tawbah is that Zakah is on Amwal money and a rental property comes under this kind of wealth. If a property is purchased with a clear intention of resale then the full value of ownership share is subject to zakat.

Rather zakaah is due on the rent that is collected from it. Remodeled Columbus Home For Rent. 2 If the property was purchased for the rental market there is no zakat payable on the value of the property.

However any rental income that remains on the zakat anniversary will be included in your zakat calculation. As far as the instalments that remain to be paid are concerned it is obvious that there is Zakat on it as this money is still with you and has not been paid. You only pay zakat on the rental income from that asset that remains in your possession on your zakat date.

I am currently paying zakat on my annual saving. Therefore in your fathers case when he gains his rental income from the property then if it stays in his ownership to the value of the Zakat-payable amount nisab whether alone or jointly with other wealth in the form of gold silver cash merchandise or livestock for a whole year then Zakat will be obligatory upon him on the rental money attained or jointly with the other wealth. Excellent Remodeled Home For Rent in Columbus.

I could not find any Hadith only Fatwa to justify that what I am doing is correct. Question 373. Is Zakat due on the house I live in.

Furthermore Islam-QA appears to have this stance as well in the. I have few investment property and have no mortgage on this property. Pay zakat on the net annual income from your property.

In addition the value of leased property is not subject to Zakat. The variety of spaces. Zakat is not due on the value of the rented property Date.

One quarter of one tenth 25 must be given as zakaah. Whatever written of Truth and benefit is only due to Allahs Assistance and Guidance and whatever of error is of me. Zakat is only applicable to certain types of properties.

With regard to the property that is rented out zakaah must be paid on the rent if it reaches the nisaab minimum threshold by itself or when other money is added to it and one full hijri year has passed since acquiring it. These Zakat assessments one makes out of the rental propertys net income not its principal after deductions for maintenance property taxes and all related operating costs like wages and benefits paid to workers etc. The Property and other fixed assets category does not include the home you live in but includes property purchased with the intention to make profit from reselling.

If you have an intention to resell a property you should pay zakat on the whole value of the property. The revenue that one generates in form of rent from these rental properties has Zakat applicable to it. However I exclude my rental properties from my annual saving.

Commercial real estate properties for lease and sale in Columbus OH. Usually zakat applies to properties that will further be used for rentals and reselling. Since your fees will be deducted from your rental income payment you are effectively paying zakat on your net annual income.

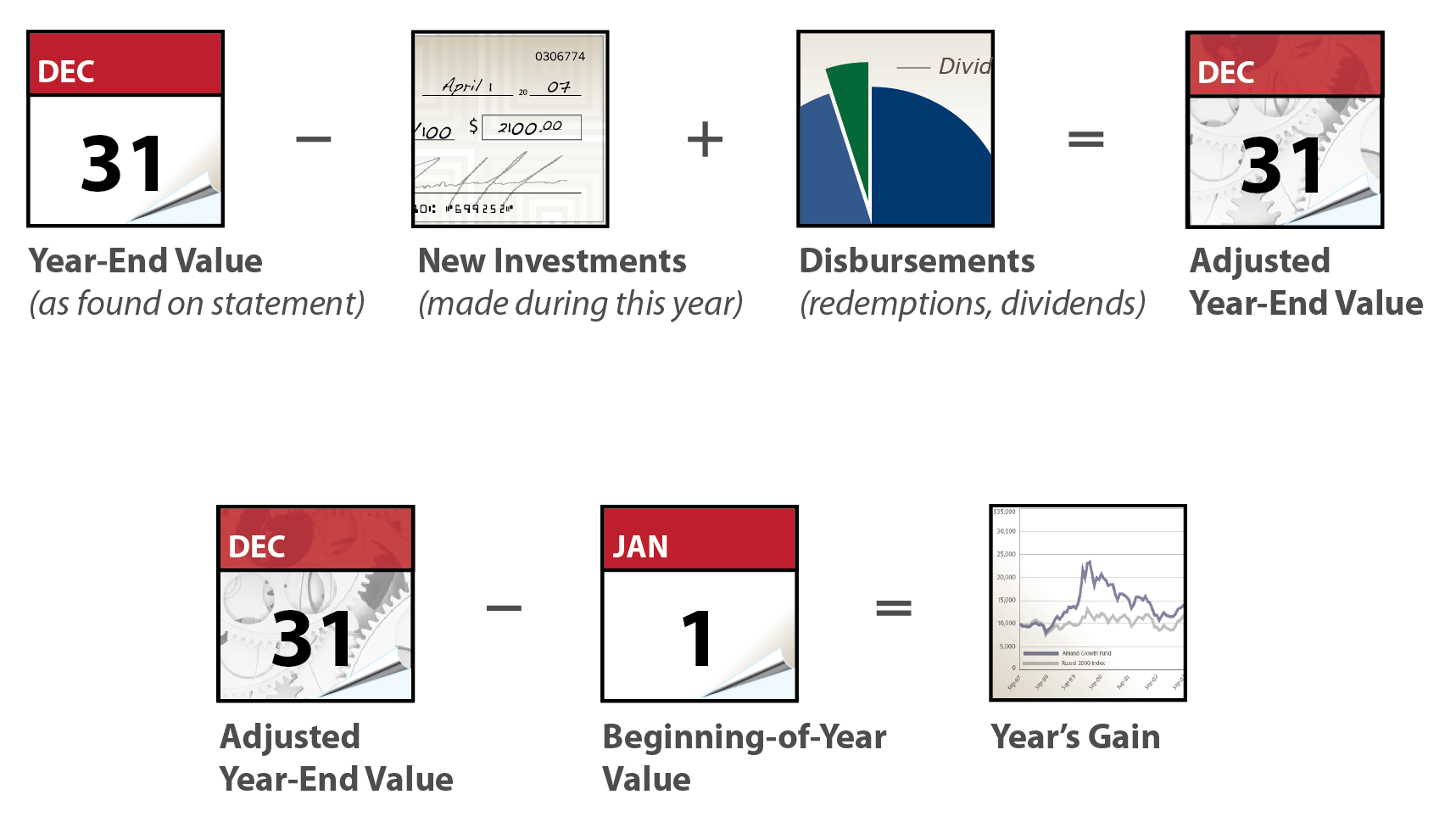

Zakat On Property How To Calculate It Where To Invest Capital Assets Property

Zakat On Money Calculation Of Zakat Om Cash And Saving Zakat

How To Calculate Zakat On Property Zakat In Islam

Is Zakat Owed On Rental Property Zakat Foundation Of America

Virginia Cooperative Extension James City County Williamsburg Master Gardeners Master Gardener Master Gardener Program Sustainable Landscaping

How To Calculate Zakat On Property Zakat In Islam

Which Business Assets Do I Need To Pay Zakat On Zakat Ke Masail Ask Abu Saif Alehsaan Tv Al Ehsaan Online Institute

How To Calculate Zakat On Property Zakat In Islam

Zakat Types In Islam How You Can Pay Part 1 Global Sadaqah Blog

How To Calculate Zakat On Property Zakat In Islam

Consuming Riba Usury Or Interest Types Of Planning Riba Financial Literacy

Solved Zakat Is An Islamic Finance Term Referring To The Chegg Com

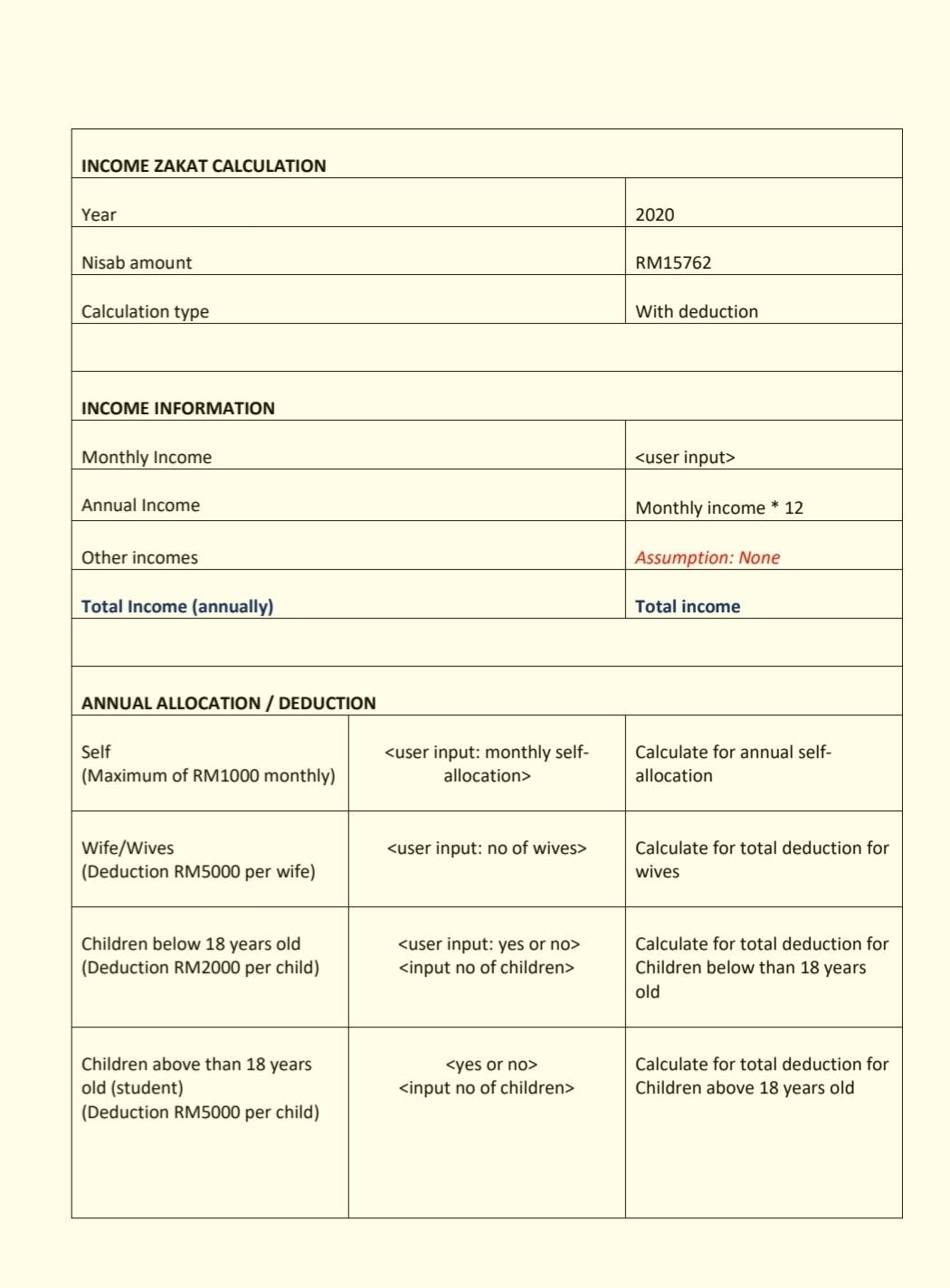

Table A Asset Calculation For Zakat

Ghauri Town Islamabad Graana Com Blog Real Estate News Real Estate Farm House For Sale Property Buyers

How To Calculate Your Personal Zakat 10 Steps With Pictures

Is Zakat Applicable On Rental Property And How Zakat Rules Zakat Calculator Ask Abu Saif Alehsaan Tv Al Ehsaan Online Institute

The Biggest Miney Wasters Investing For Beginners Business Read Investing Internet Business

Post a Comment for "Zakat On Rental Property"