Calaveras County Property Tax Rate

Note that 1109 is an effective tax rate estimate. Calaveras County Property Records are real estate documents that contain information related to real property in Calaveras County California.

San Andreas CA 95249.

Calaveras county property tax rate. 23 after their property taxes increased significantly. Calaveras County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Calaveras County CA currently has 44 tax liens available as of December 20.

The Calaveras County sales tax rate is. Payments may be made to the county tax. Search Any Address 2.

In order to determine the tax rate used for calculation of ad valorem property taxes you must have the TRA Tax Rate Area which is located near the Assessment number ASMT on the property tax bill. Calaveras County Property Tax Payments Annual Calaveras County California. Call or visit the following websites.

- Pay online either by E-Check 150 or credit card 238 fee httpsTaxcollectorcalaverasgovus or phone the automated system at 1 844 556-7131. The California state sales tax rate is currently. April 10-Last day to pay second installment of secured real estate taxes.

The tax rate is 55 for each 500 or fractional part thereof of the value of real property less any loans assumed by the buyer. The Calaveras County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan. Understanding Property Taxes Although property taxes are governed by the California State Revenue and Taxation Code.

The majority of this task is accomplished by the following three Calaveras County departments. See Property Records Deeds Owner Info Much More. This must be done at least 7 to 10 days in advance of April.

Assessor Auditor-Controller and Treasurer-Tax Collector. The median property tax on a 35080000 house is 221004 in Calaveras County The median property tax on a 35080000 house is 259592 in California The median property tax on a 35080000 house is 368340 in the United States. Get Property Parcel and Tax Information.

These buyers bid for an interest rate on the taxes owed and the right to. 38 out of 58 counties have lower property tax rates. When the Treasurer-Tax Collectors office will be open.

Alternate ways to pay. Ad Get a Vast Amount of Property Information Simply by Entering an Address. Van Nuys Los Angeles 9500.

Get In-Depth Property Reports Info You May Not Find On Other Sites. Currently Calaveras County California does not sell tax lien certificates. 891 Mountain Ranch Road.

July 1-First day of the fiscal year. View the Tax Rates for Calaveras County here. The Treasurer-Tax Collectors office will be open with normal business hours 800 am to 400 pm Monday through Friday.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Assessed value is often lower than market value so effective tax rates taxes paid as a percentage of market value in California are typically lower than 1 even though nominal tax rates are always at least 1. The Assessors Office 209 754-6356 or Tax Collectors Office 209 754-6350.

Administration of tax law is the responsibility of the Counties. Calaveras County has one of the higher property tax rates in the state at around 1109. The 2018 United States Supreme Court decision in.

- Mail in your check postmarked on or before April 10 2020. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Calaveras County CA at tax lien auctions or online distressed asset sales. The minimum combined 2021 sales tax rate for Calaveras County California is.

Calaveras County relies on the revenue generated from real estate property taxes to fund daily services. Calaveras County sells tax deed properties at the Calaveras County tax sale auction which is held annually during the month of November each year. July 2-November 30- Property owners can file an appeal with the Clerk of the Board.

This is the total of state and county sales tax rates. You Can See Data Regarding Taxes Mortgages Liens Much More. - Pay through your banks Bill-Pay service.

Tax Rate Area Information. Property Tax in Calaveras County. Home of the Jumping Frog Jubilee and Calaveras Big Trees State Park.

May 7-Last day to file Business Property Statements without penalty. 19 counties have higher tax rates. Calaveras County Assessor Leslie Davis speaks with a number of concerned property owners Feb.

Email the Tax Collector Treasurer. Pay your Property taxes in Calaveras County California Online with this service. The median property tax also known as real estate tax in Calaveras County is 219300 per year based on a median home value of 35080000 and a median effective property tax rate of 063 of property value.

December 10-Last day to pay first installment of secured real estate taxes.

Bid4assets Com Auction Detail 968163 Calaveras County Ca Apn 020 016 002

Rancho Calaveras California Ca 95252 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

About Ccwd Calaveras County Water District

Word To Live By Wise Words Spider Fly Web Quotes Motivation Motivate Web Quotes Spider Fly Life Quotes

Home Calaveras County Water District

About Ccwd Calaveras County Water District

California Public Records Public Records California Public

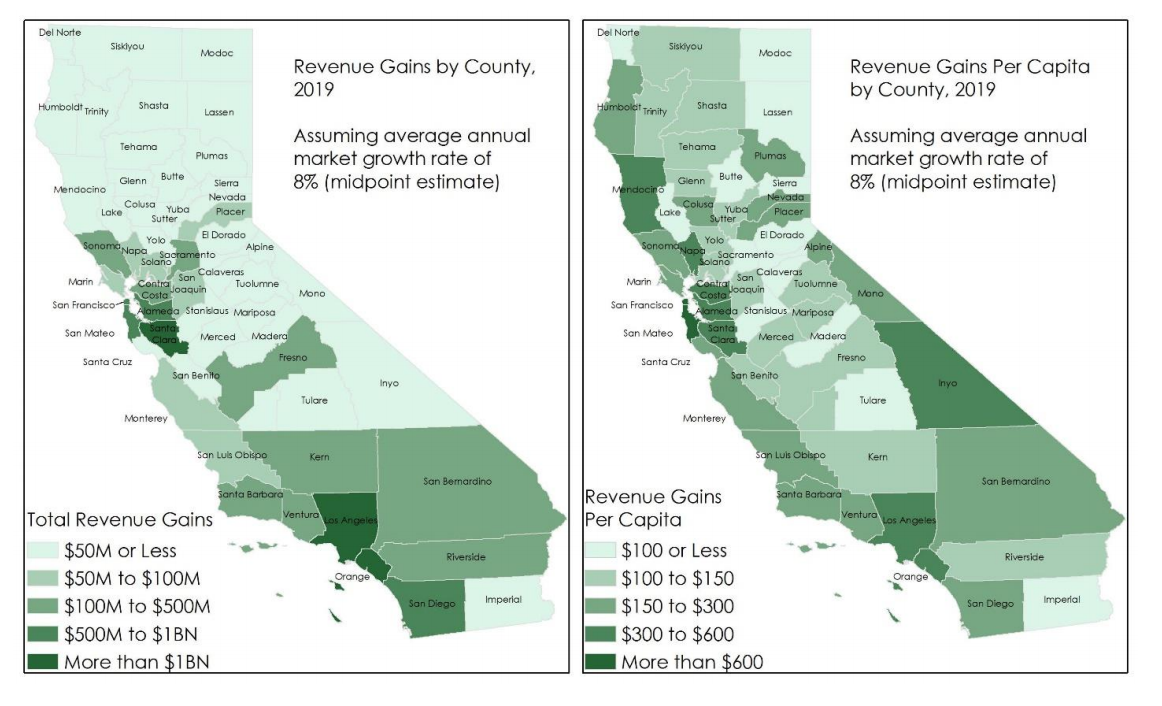

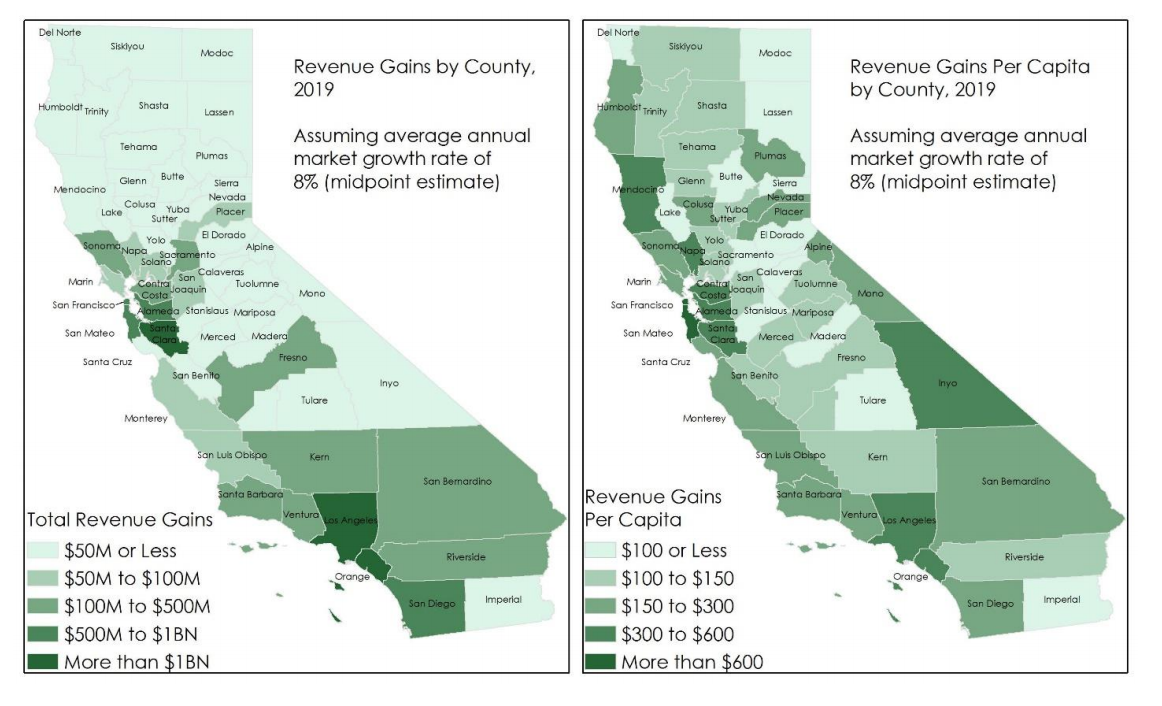

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review

Tot Overview What Is The Transient Occupancy Tax

Tot Overview What Is The Transient Occupancy Tax

Calaveras County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Calaveras County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Compare Cost Of Living In Calaveras County Ca Niche

Tot Overview What Is The Transient Occupancy Tax

Post a Comment for "Calaveras County Property Tax Rate"