Jay County Property Taxes

Non-payment of taxes for three years can result in eventual foreclosure by the County. Here you can find links to property assessment records in Delaware County information about property tax exemptions and contact information for the Assessor.

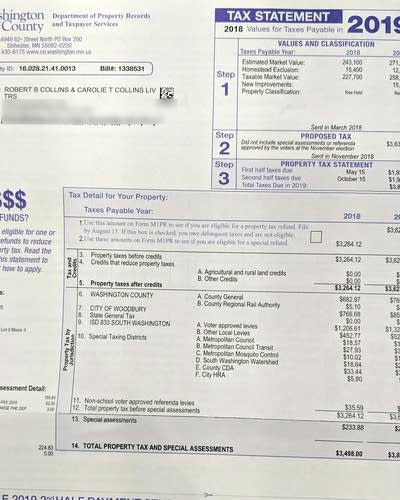

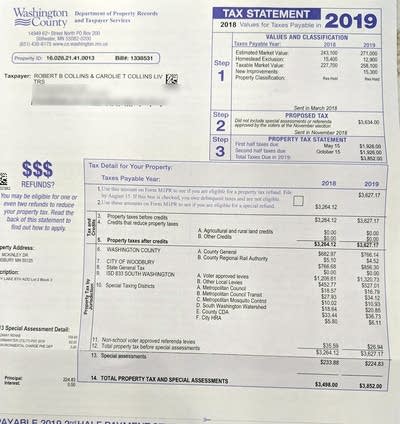

Show Us Your Property Tax Statement Mpr News

Jay County Property Tax Payments Annual Jay County Indiana.

Jay county property taxes. Search for your dream home today. A lien was recorded on this property by the creditor on 2018. There are two options for paying real property real estate taxes.

Phone 260 726-4456 Fax 260 726-6964. 0020500 Tax Due Dates. Jay County has one of the lowest median property tax rates in the country with only two thousand two hundred forty five of the 3143 counties collecting a lower property.

Search for your property. Personal Property taxes are paid in full by January 31st unless the installment option is indicated on the tax bill. Jay County Health Department Confirms First Case of Covid-19 - 03-31-2020.

Jay County collects on average 072 of a propertys assessed fair market value as property tax. PO Box 730 Au Sable Forks NY 12912 Physical Address. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

The sale must be made by auction at the office of the Sheriff of the county where the real estate is located. All postponed and delinquent personal property bills are collected by the local treasurers. As you may know our Administration Offices are in a transition period as we move to the new Kay County Administration Building.

It is not a property for sale. The certified Tax Roll records contained in this site reflect property ownership as of the date of certification and may not reflect current ownership. Ad Find County Property Tax Info For Any Address.

Search for Jay County real property and personal property tax records and parcel maps by owner name address tax map number parcel number or legal description. For best search results enter a partial street name and partial owner name ie. 120 North Court St Portland IN 47371.

This is the old home page for the Delaware County Assessor Larena Ellis Cook. The County Treasurer collects property taxes for sixteen of the nineteen municipalities within the County. Town of Jay.

The most current ownership information can be obtained from the office of the Auditor. The median property tax in Jay County Indiana is 585 per year for a home worth the median value of 81300. The median property tax also known as real estate tax in Jay County is 58500 per year based on a median home value of 8130000 and a median effective property tax rate of 072 of property value.

If you choose to pay your taxes in full payment is due by January 31st. 10012021 04012022 Commitment Date. In three municipalities first half collections are made in January to the local treasurers.

You may pay in half or in full before January 1st after that date only full payments can be accepted. July payments are made to the County Treasurer. In-depth Jay County IN Property Tax Information.

Jay County Property Records are real estate documents that contain information related to real property in Jay County Indiana. View 5 in Jay County IN. 11 School Lane Au Sable Forks NY 12912.

900am 100pm Office Phone. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a. Get Record Information For Any Address About Any County Property.

Jay County Courthouse 1st Floor. 518 647-5692 Office Email. Search by address Search by parcel number.

Jay County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by property tax collections. 124 Main rather than 124 Main Street or Doe rather than John Doe. This is a tax lien listing.

Paula Miller Jay County Treasurer. The 2021 tax statements have been mailed and are now payable. 518 647-5692 Office Email.

Please E-mail Office Phone. Median Property Taxes Mortgage 565. The second half payment is due before April 1st 2021.

Former Supervisors Office First Floor 11 School Lane Au Sable Forks NY 12912. The Sheriff must sell property on foreclosure in a manner that is reasonably likely to bring the highest net proceeds from the sale after deducting the expenses of the offer and sale. The Jay County Health Department in consultation with the Indiana State Department of Health ISDH and the local medical community has confirmed the first case of novel coronavirus COVID-19 in a county resident.

The median property tax on a 8130000 house is 58536 in Jay County The median property tax on a 8130000 house is 69105 in Indiana The median property tax on a 8130000 house is 85365 in the United States. PO Box 730 Au Sable Forks NY 12912 Physical Address. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number.

Show Us Your Property Tax Statement Mpr News

Property Tax By County Property Tax Calculator Rethority

Pin By Otaxly On Otaxly Com Tax Deductions List Tax Deductions Paying Taxes

County Town City Tax Information Clinton County New York

Property Tax By County Property Tax Calculator Rethority

Property Tax By County Property Tax Calculator Rethority

Show Us Your Property Tax Statement Mpr News

Several Wash Counties Extending Property Tax Deadlines Amid Pandemic Komo

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

About Lower My Texas Property Taxes

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

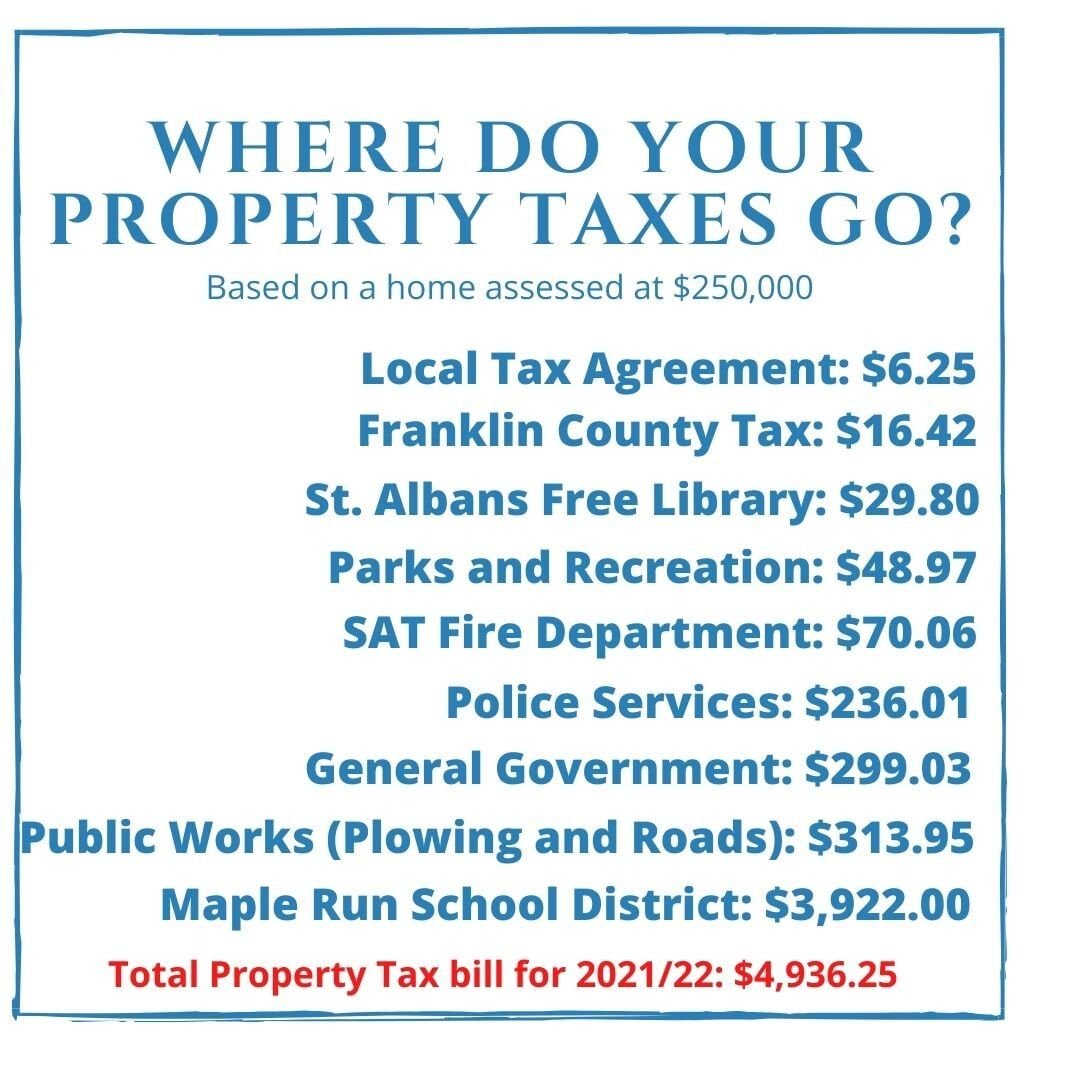

This Is How Much Property Taxes Increased In St Albans Town News Samessenger Com

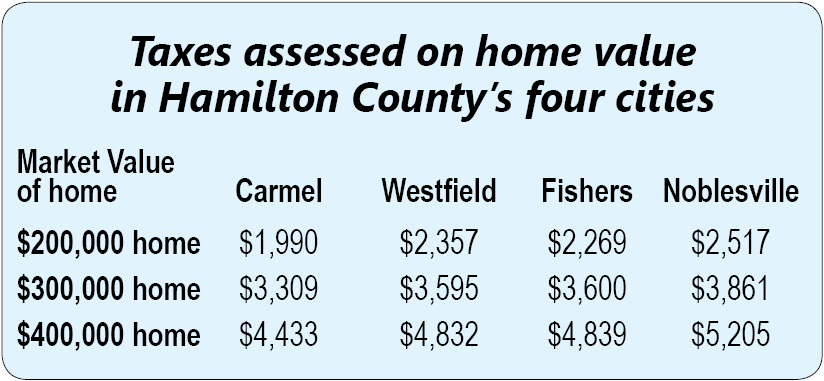

Carmel S Property Taxes Fifth Lowest In Indiana Hamilton County Reporter

Property Tax Credit Averages 2 28 Per Acre Tax Credits Property Tax Tax

Company Rates Stanislaus County In Top 10 Where Property Taxes Go Farthest Ceres Courier

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Post a Comment for "Jay County Property Taxes"