Carver County Property Tax Info

Perform a free Carver County MN public record search including arrest birth business contractor court criminal death divorce employee genealogy GIS inmate jail land marriage police property sex offender tax vital and warrant records searches. Start Your Search Now.

403 Columbus Avenue S New Prague Mn 56071 Mls 5685509 Themlsonline Com Real Estate House System Home Mortgage

Carver County Property Records.

Carver county property tax info. Carver County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Carver County Minnesota. Real estate taxes are now billed on a quarterly basis with due dates of August 1 st November 1 st February 1 st and May 1 st. 1 The Countys GIS.

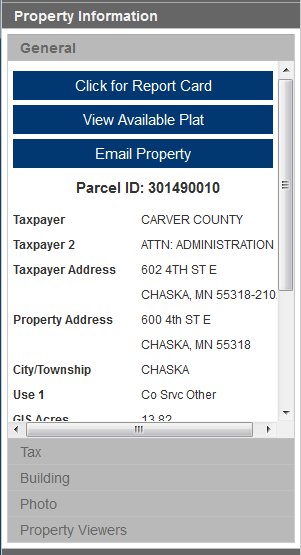

The fee is 235 of the amount being paid with a minimum charge of 120. Online payments made from this site and will only be applied to the current year tax bill. The Carver County Property Information application provides online access to geographic and tax record information currently maintained by departments within Carver County.

Find a PID or an address ex301490010 or 600 4th Street East Chaska Search. The third and fourth quarter bills. These records can include Carver County property tax assessments and.

Search Property Tax Records Pay Taxes Online. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Ad Scan Millions of Property Records in Your State to Find Property Tax Information Online.

Carver County Crime Viewer. Carver County Assessors Office Property Records Report Link httpswwwcocarvermnusdepartmentsproperty-financial-servicesproperty-assessment. Please review the disclaimer for intented use of the application.

1558 Edgebrook Ln Carver MN 55315 552999 MLS 6131636 Ready to move in Brand NEW EAST facing Lennar Single Family Home with a private backyard i. Assessment ratio is currently set to 100 throughout Carver County. 4 beds 3 baths 2355 sq.

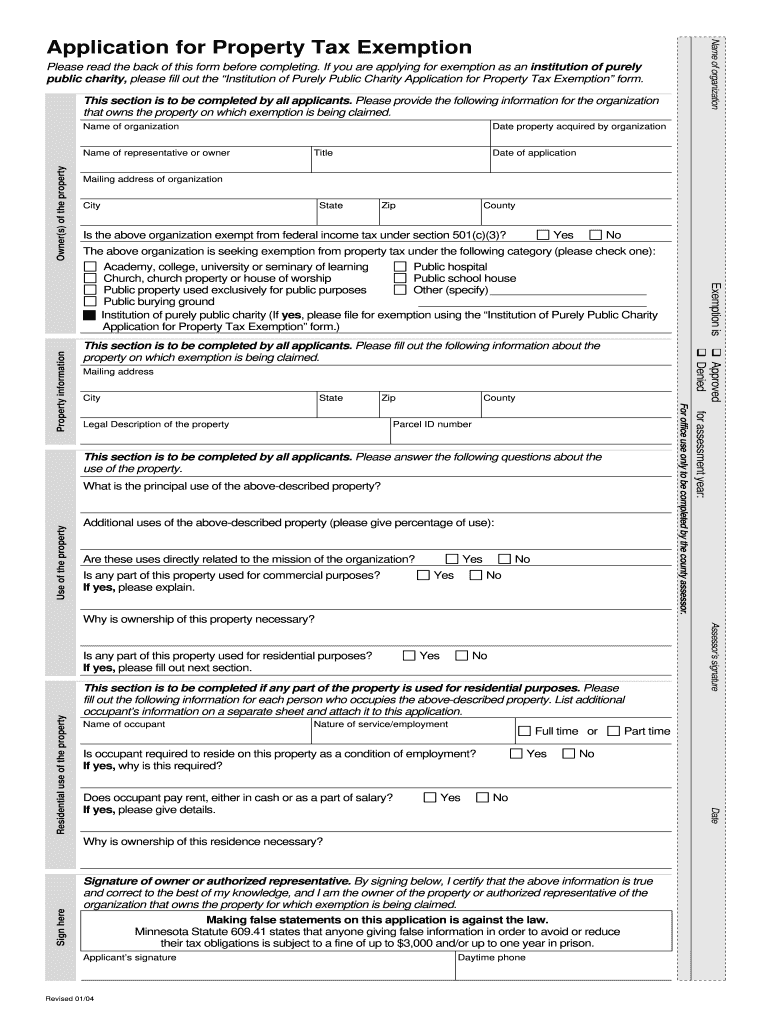

Carver County Property Tax Department. Ad Tax Exemption More Fillable Forms Register and Subscribe Now. See debts secured by the property deed.

It may have been derived from deeds or other sources. The Carver County Public Records Minnesota links below open in a. To compare Carver County with property tax rates in other states see our map of.

Get In-Depth Property Reports Info You May Not Find On Other Sites. The Eastern Carver County School Board unanimously approved putting an operating referendum in front of voters in the November 2 2021 election. Learn the current and past owners of the home.

Search Any Address 2. Find out how much the home owner owes on their house. The average-value homeowner in the county will pay 106 on the countys portion of the tax bill each month.

Request a Crime Report. The Treasurer manages the Towns property which is in Tax Title or Foreclosure. The operating levy is a strategic investment in sustaining and building the districts high quality educational and programming activities into the future.

The fees are retained by a third party payment processor. The 10-year operating levy would provide an. Of those taxes paid the.

Property Information Map Search mobile. Property Information Map Search. See Note 2 Notes.

The Carver County Property Tax Department makes every effort to produce and publish the most. See Note 1 Net Acres - The parcel polygon area as mapped and stored in the GIS parcel database less any mapped ROW. Delinquent property is turned over to the Treasurer annually when the Collector does a tax taking ie puts a lien on the property.

Report a Crime Tip. Carver County Assessment Rolls Report Link httpsgiscocarvermnuspublicparcel Search Carver County property assessments by tax roll parcel number property owner address and taxable value. Mapped Acres - Calculated acreage of the parcel polygon as mapped and stored in the GIS parcel database.

Carver County collects the highest property tax in Minnesota levying an average of 299200 104 of median home value yearly in property taxes while Koochiching County has the lowest property tax in the state collecting an average tax of 64100 064 of median home value per year. The Carver County Assessors Office located in Chaska Minnesota determines the value of all taxable property in Carver County MN. The first two quarterly bills due August 1 st and November 1 st are preliminary bills each based on 25 of the prior years total tax bill.

See annual property tax assessments and tax trends. Contact the Sheriff Department at 952-361-1212. View a Propertys Tax History Assessment Value Estimates More.

Tax Acres - Acreage stored in the Countys tax system. Assessors are responsible for estimating property values and setting classification for tax purposes. See Property Records Deeds Owner Info Much More.

If this is your first. Each propertys share of taxes is determined according to its value use and the property tax levies.

Tax Information City Of Katy Tx

Sherburne County Property Tax Records Sherburne County Property Taxes Mn

/cloudfront-us-east-1.images.arcpublishing.com/gray/QAPEESMZYFDYPN4U6GKRKG2G64.jpg)

Tax Exemption Could Save Elderly Residents Thousands On Property Taxes

Timeline For Property Taxes Carver County Mn

Property Tax By County Property Tax Calculator Rethority

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Dekalb County

Tax Information City Of Katy Tx

Property Tax By County Property Tax Calculator Rethority

Real Estate Humor Real Estate Humor Real Estate Fun Realtor Fun

Homestead Information Carver County Mn

Property Tax Appeal Appeal Your Property Taxes

Mn Application For Property Tax Exemption Carver County 2004 2021 Fill Out Tax Template Online Us Legal Forms

550 Per Pupil Tax Levy Increase On Nov 2 Ballot For Eastern Carver County Schools Chanhassen Education Swnewsmedia Com

Property Assessment Carver County Mn

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Orange California

Property Tax By County Property Tax Calculator Rethority

Post a Comment for "Carver County Property Tax Info"