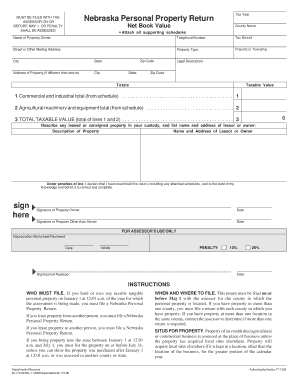

Nebraska Personal Property Return

A Nebraska personal property tax return must be filed on or before May 1 by. A Owned or held on January 1 1201 am.

Contact Us Nebraska Department Of Revenue

Anyone that owns or holds any taxable tangible personal property on January 1 1201 am.

Nebraska personal property return. Register of Deeds Forms. Owned or held on January 1. If the property has situs in more than one county a personal property return must be filed in each county.

See above for further instructions. Anyone that leases personal property to another person. Personal property is defined as tangible depreciable income producing property including machinery and equipment furniture and fixtures.

Personal property is defined as tangible depreciable income-producing property including machinery and equipment furniture and fixtures. Any taxable tangible personal property. DO NOT mail personal property returns to the Department of Revenue.

We cannot complete documents for customers or offer legal advice. Lease depreciable taxable tangible personal property from another. County Assessor address and contact information.

Personal Property Return Nebraska Net Book Value. Since May 1 2021 falls on a Saturday in 2021 the Nebraska Personal Property Return and Schedules must. Machinery and equipment value exempted for three years.

A Nebraska Personal Property Return and Schedule must be filed for all depreciable tangible personal property that is. You can access pre-printed returns based on. Nebraska calculates personal property value by its net book value through a Depreciation Factor Table.

Hold or own any depreciable taxable tangible personal property on January 1 at 1201 am. All taxable tangible personal property must be reported each year. Anyone that owns or holds any taxable tangible personal property on January 1 1201 am.

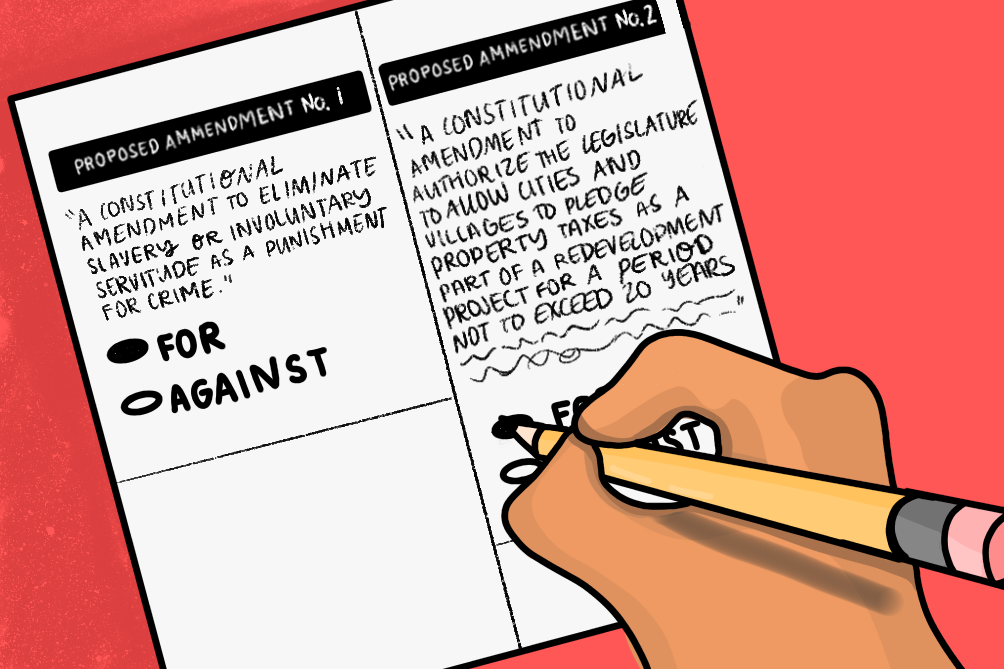

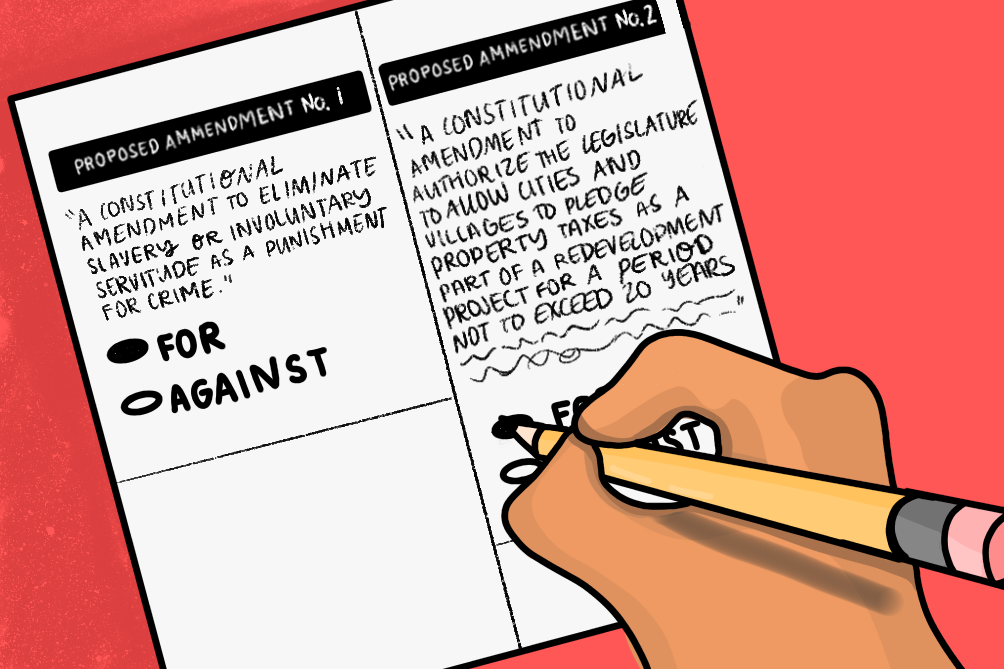

Who must file a Nebraska personal property return. Below is an example from the Nebraska Personal Property Return form. If you e-file your own return using software you have purchased or accessed from the.

Personal property is defined as tangible depreciable income-producing property including machinery equipment furniture and fixtures. Anyone that owns or holds any taxable tangible personal property on January 1 1201 am. You must file a Personal Property Return if you.

Owners of personal property that the Nebraska Personal Property Return and Schedule must be filed on or before May 1 with the county assessor where the personal property is located. Anyone who owns or holds any taxable tangible business personal property on January 1st 1201 am. Anyone that owns or holds any taxable tangible personal property on January 1 1201 am.

Property located in Nebraska must file a Personal Property Return with the county assessor in the county in which the personal property has situs. Since May 1 2021 falls on a Saturday in 2021 the Nebraska Personal Property Return and Schedules must be filed on or before Monday May 3 2021. Who must file a Nebraska personal property return.

Anyone that leases personal property to another person. Nebraska Personal Property Return must be filed with the County Assessor on or before May 1. The Nebraska Department of Revenue Property Assessment Division reminds owners of personal property that the Nebraska Personal Property Return Schedule must be filed on or before May 1 with the county assessor where the personal property is located.

Failure to timely report taxable tangible personal property on the return will result in a forfeiture of this exemption for untimely reported personal property. 16 As property ages its assessed value also decreases at a set rate. If you lease depreciable taxable tangible personal property from another person you must file a Nebraska Personal Property Return.

Internet you will be required to mail in a Nebraska Form 4868N. Anyone that leases personal property from another person. The Register of Deeds Office is a recording office only.

Nebraska Department of Revenue. The forms available on our website are offered only as a courtesy. Who Must File A Nebraska Personal Property Return.

Personal Property Return and Schedule. Who must file a Nebraska personal property return. Anyone that leases personal property from another person.

Nebraska personal property returns and schedules are due annually on or before may 1. For example an assessment ratio of 50 means that only half of the value of the property is taxable. Nebraska Personal Property Return PDF Homestead Exemption Forms.

The Nebraska return when filed. Anyone who leases business personal property from another. Leased Equipment Form Douglas County Contact.

Of the year for which the assessment is being made. The applicant must file a Personal Property Return with the county assessor on or before May 1 of each year to receive this exemption. Also please note that with passage of LB1107 by the Nebraska Legislature the 10000 exemption for Personal Property Returns has been eliminated for 2020 and all subsequent tax years.

All persons partnerships corporations proprietorships companies firms farmers ranchers and other entities holding or owning tangible depreciable personal property subject to taxation on January 1 1201 am of each year must file a Nebraska Personal Property return. Who must file a Nebraska personal property return. Anyone who owns or holds any taxable tangible personal property on January 1 1201 am.

Anyone that leases personal property to another person. Personal Property Homestead. A Nebraska Personal Property Return and Schedule must be filed for all depreciable tangible personal property that is.

If you have an authorized IRS tax preparer e-file your return Nebraska will grant you an automatic extension to file. If May 1 falls on a. 800-742-7474 NE and IA.

If you lease depreciable taxable tangible personal property to another person you must file a Nebraska Personal Property Return unless the property is listed and valued on a return filed by the lessee.

Nebraska Warns Of Delays On Some Income Tax Returns Klkn Tv

Which Type Of Legal Description Is This Plat Of Block 28 Woodmen Heights Tract Recorded In Map Book 27 Page 68 At The Eldor County Records Office Signnow

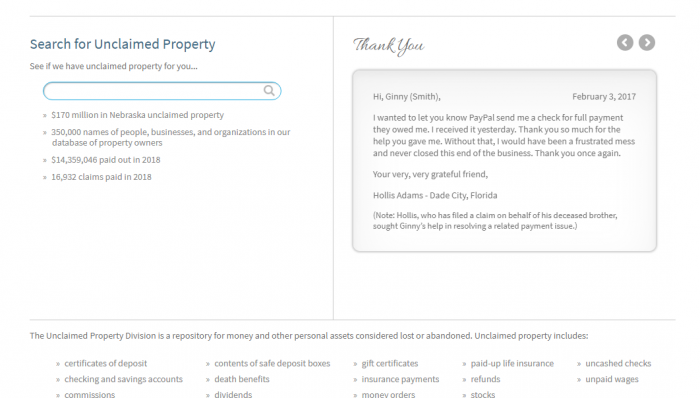

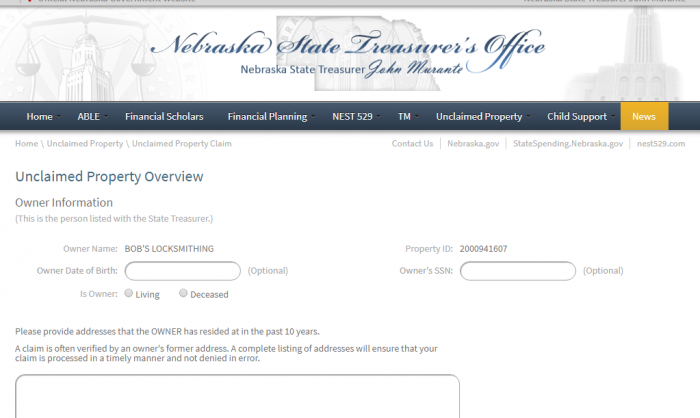

Find Nebraska Unclaimed Property 2021 Guide

Pennsylvania Property Tax H R Block

Beach Vote For Both Of The Nebraska Constitutional Amendments Opinion Dailynebraskan Com

Nebraska Llc How To An Llc In Nebraska

General Fund Receipts Nebraska Department Of Revenue

Hayes County Assessor Personal Property Information

Ik Ondergetekende Fill Online Printable Fillable Blank Pdffiller

Contact Us Nebraska Department Of Revenue

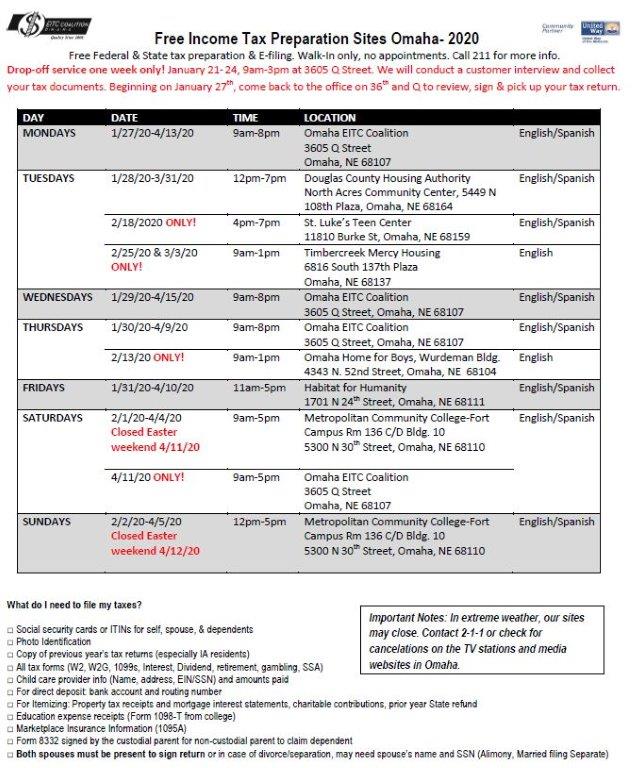

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

New Payment Option In Nebfile For Business Sales And Use Tax Nebraska Department Of Revenue

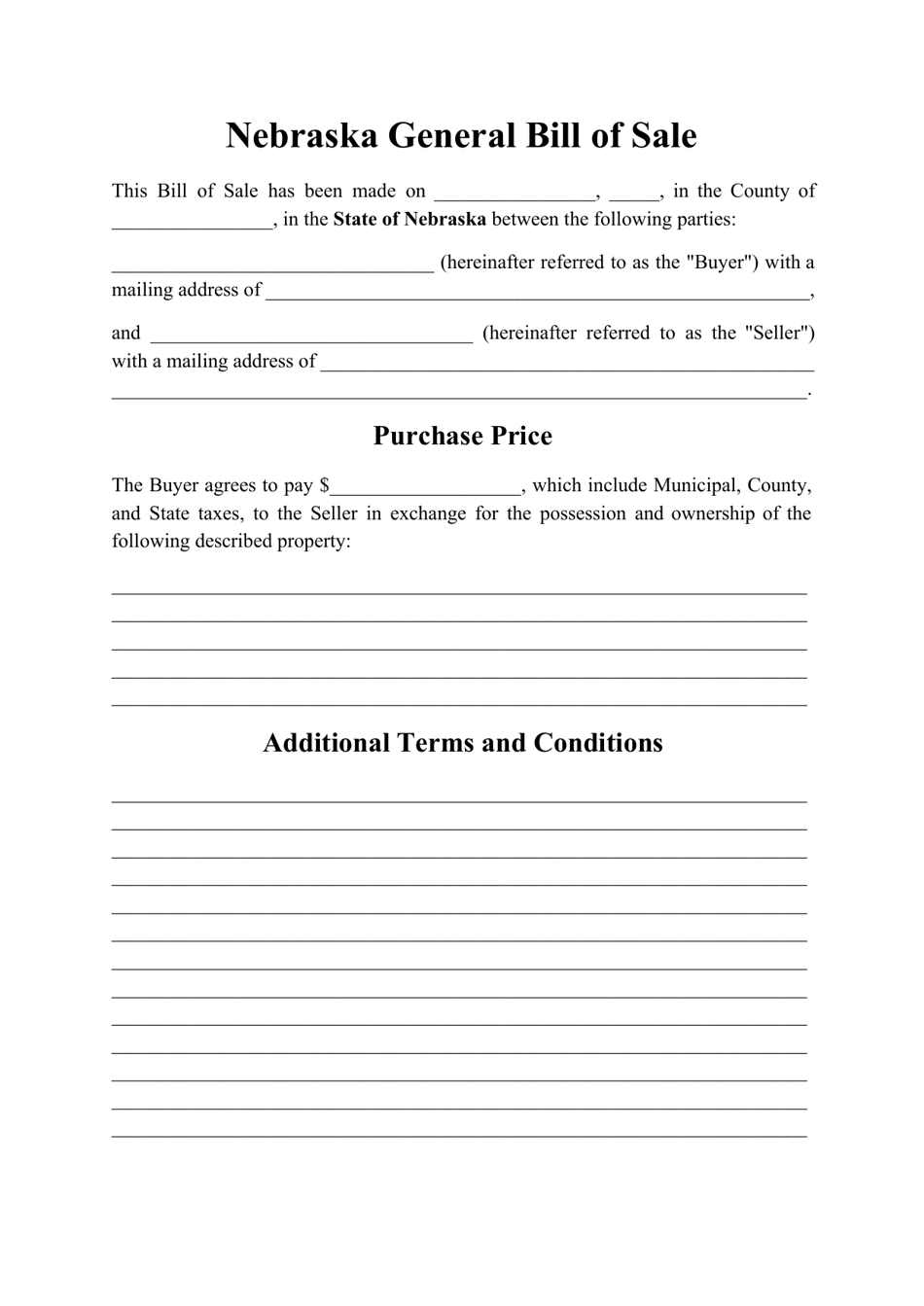

Nebraska Generic Bill Of Sale Form Download Printable Pdf Templateroller

Find Nebraska Unclaimed Property 2021 Guide

Post a Comment for "Nebraska Personal Property Return"