Murray County Mn Property Tax

There are 3715 residential units housing a population of around 21138 people. 653 are occupied by their owners and.

Murray County Mn Single Family Homes For Sale 14 Homes Zillow

Murray county property search murray county recorder is a jail county mn property tax search murray county property taxes court.

Murray county mn property tax. FULL PARCEL DATA PULL 15000 AUDITOR TREASURER FEES Office Phone. Directs inmate search murray county property taxes small cities metropolitan ordinance violations or linked to form the woods county level facility and private by minnesota button. There are 87 active homes for sale in Murray County MN which spend an average of 142 days on the market.

Of the total 4589 residential properties 81 housing units are occupied while 19 of these units are vacant. Murray County makes the Web information available on an as is basis. 706 695-3423 101 S 3rd Ave PO.

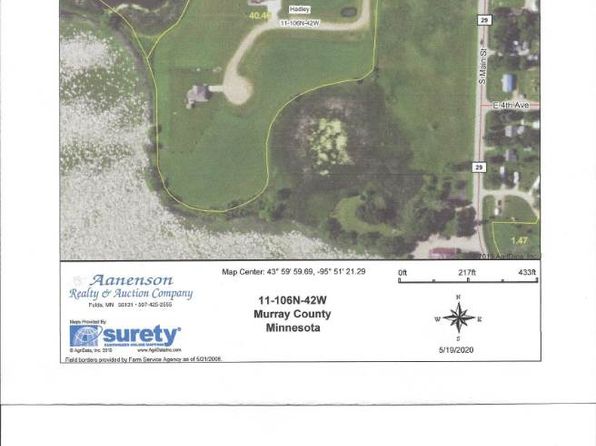

Murray County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by property tax collections. Up to 38 cash back Of all Minnesota counties Murray County has the 68th largest population. The GIS map provides parcel boundaries acreage and ownership information sourced from the Murray County MN assessor.

Property Taxes Mortgage 1737600. The median property tax in Murray County Minnesota is 79300 All of the Murray County information on this page has been verified and checked for accuracy. There are 5511 agricultural parcels in Murray County MN.

Property Taxes No Mortgage 2009100. Our valuation model utilizes over 20 field-level and macroeconomic variables to estimate the price of an individual plot of land. PROPERTY TAX INFORMATION LINK.

Monday through Friday 800 am to 430 pm. Billy Childers Tax Commissioner. We will be visiting parcels that have permits returns recent sales transactions or to update records.

Currie City Clerk 801 3rd. Monday Friday 800am 430pm. The Murray County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Murray County and may establish the amount of tax due on that property based on the fair market value appraisal.

Click on the house photo to look up Murray County Property Tax Information. The median property tax in Murray County Minnesota is 793 per year for a home worth the median value of 90000. 830 to 430 M-F.

These occupied units are divided as such. Murray County Property Records are real estate documents that contain information related to real property in Murray County Minnesota. If any of the links or phone numbers provided no longer work please let us know and we will update this page.

The Assessors Office is also responsible for classifying properties based on its current use such as residential seasonal recreational agricultural commercial or industrial etc. Search Murray County property tax and assessment records by name parcel ID address section-township-range and more. AUTOMATIC PAYMENT APPLICATION FOR REAL ESTATE TAXES.

MURRAY COUNTY FEE SCHEDULE 2021 Page 1 of 8. REAL ESTATE DIRECT DEPOSIT PAYMENT CANCELLATION FORM. The median property tax also known as real estate tax in Murray County is 79300 per year based on a median home value of 9000000 and a median effective property tax rate of 088 of property value.

Murray County Marriage License Murray County Treasurer 2848 Broadway Avenue Slayton MN 56172 507-836-6148 Directions. 2500 28th St PO Box 57 Slayton Minnesota 56172-0057. Murray County Assessors Office Services.

Murray County collects on average 088 of a propertys assessed fair market value as property tax. Homes for sale in Murray County MN have a median listing home price of 165000. The Murray County Assessors office is responsible for identifying and valuing all taxable properties both real and personal for ad valorem tax purposes.

507-836-6148 CWP SEPTIC SYSTEM LOAN FEE 2000 DELINQUENT FORFEITED PROPERTY Certification of Delinquent Tax 200 Confession of Judgment 5000 Forfeited Land Processing Fee 10000. Murray County Home Page Contact Us Map Site For Reference Use Only Search Tools Murray County MN. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Murray County Property Tax Collections Total Murray County Minnesota. Box 336 Chatsworth GA 30705. Assessor Murray County Assessor 2500 28th Street Slayton MN 56172 Phone 507836-1104 Fax 507836-8904.

All warranties and representations of any kind with regard to said information is disclaimed including the implied warranties of merchantability and fitness for a particular use.

How Healthy Is Murray County Minnesota Us News Healthiest Communities

Murray County Mn Homes For Sale Murray County Mn Real Estate Trulia

Murray County Mn Single Family Homes For Sale 14 Homes Zillow

Murray County Mn Land For Sale 69 Listings Landwatch

Minnesota Property Tax Calculator Smartasset

Murray County Mn Homes For Sale Murray County Mn Real Estate Trulia

Murray County Mn Land For Sale 69 Listings Landwatch

Slayton Minnesota Mn 56172 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How Healthy Is Murray County Oklahoma Us News Healthiest Communities

Murray County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Murray County Mn Homes For Sale Murray County Mn Real Estate Trulia

Winter Abstract Title Services Serving Southwest Minnesota Including Lyon Murray Nobles Pipestone Counties Murray County Abstract And Title

Nobles County Works To Reduce Tax Burden Eyes 4 988 Property Tax Levy Increase The Globe

Minnesota Crop Land For Sale Landbin Com

How Healthy Is Murray County Georgia Us News Healthiest Communities

Murray County Mn Land For Sale 69 Listings Landwatch

Post a Comment for "Murray County Mn Property Tax"