Coalition For Property Tax Justice

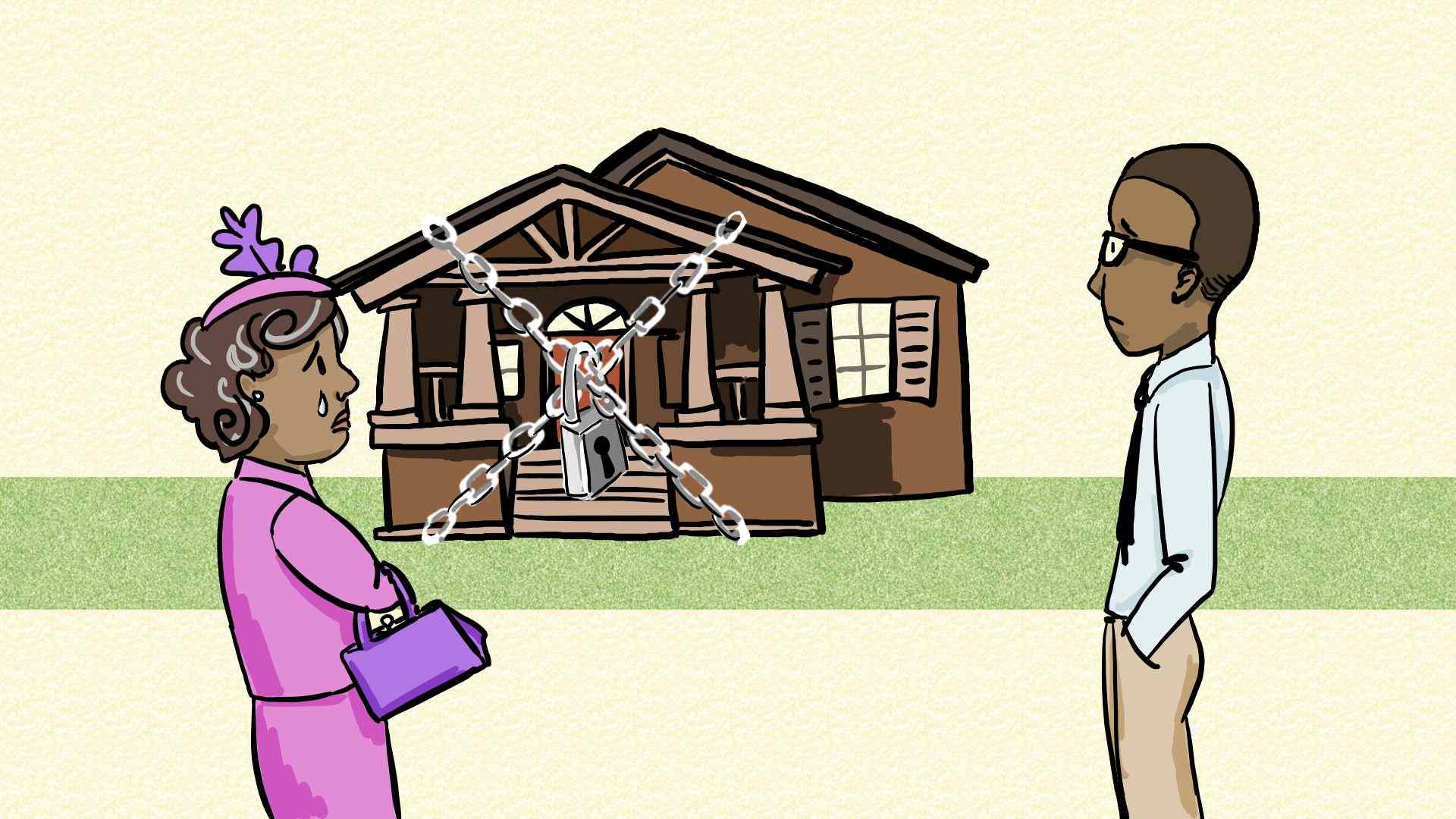

In Milwaukee officers suspended with pay are the. The Coalition for Property Tax Justice is a collection of Detroit-based non-profits and community organizations fighting for those who have lost their homes or are at risk of losing their homes due to unconstitutional tax foreclosures.

:format(jpeg)/f/98111/1600x685/f930e15bb6/detroit-famliy2.jpeg)

About Coalition For Property Tax Justice

Hartman 0064242 THE LAW FIRM OF CURT C.

Coalition for property tax justice. Cornel West and Rev. Stop Property Tax Injustice in Detroit. The City of Detroit and Wayne County have stolen tens of thousands of homes and generations of wealth from Detroit homeowners.

The Coalition for Property Tax Justice joined Wednesday with the American Civil Liberties Union of Michigan for a press conference urging. No accountability at all - Dr. The Coalition For Property Tax Justice is seeking applicants to assist with several research and outreach projects related to the property tax foreclosure crisis in Detroit.

Congresswoman Rashida Tlaib Dr. This hard fought win saved 2400 Detroit homeowners from eviction in the midst of a global pandemic. Coalition for Property Tax Justice was live.

David Baldingers group the Pennsylvania Taxpayers Cyber Coalition has sought to end the states dependence on property taxes to pay for schools for years. Wayne County through its property tax revolving fund is the primary financial beneficiary of the tax delinquency and foreclosure in Detroit. The report card reflects whether each candidate in writing committed.

The greed the graft and how the government facilitates that greed and graft with no accountability. Building the Engine of Community Development in Detroit BECDD is a citywide process to strengthen all of our neighborhoods by building a coordinated equitable system for community development work in Detroit. Enter an Address to Receive a Complete Property Report with Tax Assessments More.

William Barber II spoke out against Detroits illegally inflated property taxes which have caused the greatest number of property tax foreclosures in any city since the Great Depression. We are in need of a community organizing consultant to help in our advocacy efforts. Also the State Tax Commission took control of Detroits Assessment Division from 2014-2017 and must be held accountable.

Detroit A coalition fighting for fairness in property tax assessments joined with economists legal and finance scholars Thursday to call. In 2020 100 of our clients appeals were successful. The State and County must create a compensation fund for Detroit residents.

Also since 2008 Detroit has been illegally inflating its property taxes in violation of the Michigan Constitution which clearly decrees that. The Property Tax Appeal Project is a free legal service provided by the University of Michigan Law School and the Coalition for Property Tax Justice. Ad Search County Records in Your State to Find the Property Tax on Any Address.

Valade Park is located at 2670 Atwater Street Detroit MI 428207. In testimony yesterday Thursday May 14 before the Public Safety and Health Committee regarding the case of suspended Milwaukee Police Officer Michael Mattioli some observers were surprised to learn that the officer was being paid during the suspension. Since 2008 1 in 3 Detroit homeowners have lost their homes due to tax foreclosurethe highest number of tax foreclosures in any city since the Great Depression.

The Coalitions work focuses on the following problem. From 2011-2015 1 in 4 Detroit homes have been subject to property tax foreclosure. HARTMAN 3749 Fox Point Court Amelia Ohio 45102 Tel.

PTAP is a free legal service provided by the University of Michigan Law School and the Coalition for Property Tax Justice to help you understand the property tax appeal process and file an appeal. Founded in 2017 the Coalition For Property Tax Justice is a collective of several long-standing Detroit grassroots organizations formed to accomplish three goals. Since 1994 COHHIO has worked on behalf of every Ohioan in.

We encourage responsible activism and do not support using the platform. Coalition for Property Tax Justice. In May 2021 the Coalition for Property Tax Justice and community members forced Wayne County Treasurer Eric Sabree to extend the moratorium on property tax foreclosures.

3578 likes 18 talking about this 14 were here. The Projects trained legal advocates can help you understand the property tax appeal process and file an appeal. COALITION OPPOSED TO ADDITIONAL SPENDING TAXES Counsel for Amici Curiae Ohio Liberty Council Ohio Freedom Alliance and Coalition Opposed to Additional Spending Taxes Curt C.

Write your City Council candidates to tell them to demand property tax justice stop foreclosures right past wrongs and keep Detroiters in their homes. 1 Stop unconstitutional property tax assessments 2 Compensate Detroit residents who overpaid or have already lost their homes because of illegally inflated property taxes. May 15 2020.

Opt in to email updates from Coalition for Property Tax Justice Action Network is an open platform that empowers individuals and groups to organize for progressive causes. Founded in 2017 the Coalition For Property Tax Justice is a collective of several long-standing Detroit grassroots organizations formed to accomplish three goalsStop unconstitutional property. Coalition On Homelessness and Housing in Ohio Columbus.

The Coalition for Property Tax Justice filed a federal class-action lawsuit claiming the city of Detroit Wayne County and state officials eviscerated every homeowners due process rights by denying them the ability to appeal inflated property taxes. Despite the City of Detroits 2017 attempt to correct this pervasive illegality the inflated. Between 2009-2015 the City of Detroit assessed the property value of 53 to 84 percent of homes in violation of the Michigan Constitution which prohibits localities from assessing any property at more than 50 percent of its market value.

The Coalition for Property Tax Justice diligently reached out through email Facebook Twitter and phone to each City Council candidate on the November ballot.

Donate Austin Justice Coalition

Riverfront Event Offers Advice On Detroit Tax Burdens Plus Pizza

Bernadette Atuahene Profatuahene Twitter

Detroit Faces Reckoning Lawsuit From Over Taxed Homeowners

:format(png)/f/88593/600x322/83cb0ab01d/logo.png)

About Coalition For Property Tax Justice

The Coalition For Property Tax Justice On Twitter The City Hasn T Compensated Homeowners For The Money It Stole In Property Taxes Since 2011 Sign Our Petition Demanding That Mayor Duggan And Detroit S

Bernadette Atuahene Profatuahene Twitter

Riverfront Event Offers Advice On Detroit Tax Burdens Plus Pizza

Bernadette Atuahene Profatuahene Twitter

Detroit Faces Reckoning Lawsuit From Over Taxed Homeowners

About Coalition For Property Tax Justice

Coalition For Property Tax Justice Champion Of The People Beverly Kindle Walker Facebook

Tax Justice Group Calls On Detroit To Fix Unfair Property Assessments

Dream Of Detroit Home Facebook

Bernadette Atuahene Profatuahene Twitter

:format(jpeg)/f/98111/1600x685/f930e15bb6/detroit-famliy2.jpeg)

About Coalition For Property Tax Justice

Post a Comment for "Coalition For Property Tax Justice"